Even though the mainstream media was looking to so-called fundamentals — such as the action of the dollar or bond yields — Elliott Wave International focused on the patterns of investor psychology

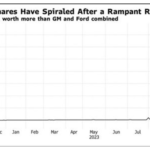

A.I. Revolution and NVDA: Why Tough Going May Be Ahead

The topic with all the buzz these days is Artificial Intelligence (AI) and its future. The potential benefits include automating repetitive tasks, enhancing productivity, data analysis, assisting in medical research — and more.

… the mood surrounding AI is way more optimistic than pessimistic.

Just think about how investors have bid up the price of AI-related stock Nvidia Corp., which has a market capitalization of around $2 trillion. That’s more than the GDP of Australia or South Korea. Indeed, if Nvidia was a country, it would rank just outside the top ten largest economies on Earth. Yet — a word of caution: Trends generally don’t go up or down in straight lines without significant interruptions.

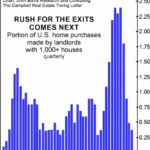

U.S. Real Estate: A 24% Problem

Real estate prices have reached absurdly high prices because corporate investors have taken over the housing market from individuals in a program encouraged, once again, by the federal government. “…24% of U.S. single family homes are owned by investors.” When the bulk of participants in the market are consumers who think of houses as shelter, prices are stable. When a significant portion of participants in the market are speculators who think of houses as investment items, prices soar and crash.

Update on China’s Big Housing Bust

Major red flags for the Chinese real estate market… China’s home prices are falling… Yet, economists have been dismissive of this threat.

Mini-Manias: Beware Short-Term Trading Frenzies – Like This One

Most investors know the meaning of a “mania,” i.e., the “Tulip Mania” of the 1600s and more recently, the mania surrounding technology stocks in the late 1990s, etc.

As you might imagine, these manias usually occur during rip-roaring bull markets.

Yet, some “manias” may unfold even during bear-market rallies, and when these “mini-manias” end, they can burn investors just as much as those full-blown bull market manias.

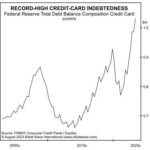

Why You Should Expect a Once-in-a-Lifetime Debt Crisis

The following article by Elliott Wave International looks at the possible impact of the building debt crisis. We’ve all heard about the massive problem of College debt created by the easy-money policies of the government. But today we are looking at the impact of the massive credit card debt.

Why Do Traders Really Lose Money?

We’ve all probably heard that “the odds are stacked against the small trader” when it comes to the stock market. That tends to push us toward investment tools like index funds. But what if the problem isn’t the market but our own brain? In today’s article, the writers at Elliott Wave International examine the psychological profile that turns winners into losers. Plus, 1 FREE course on how to help you stop self-sabotaging “good enough” trades.

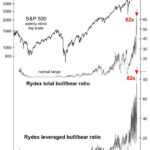

Quick Takes on Big Financial Trends

Sentiment indicators… can tell you the extent to which [people] are extremely optimistic or pessimistic. Well, 2021 was a year like no other. Finally, in December 2021, I put out an issue called “A Stock Market Top for the Ages.”

Stocks and Junk Bonds: “This Divergence Appears Meaningful”

The trends of the junk bond and stock markets tend to be correlated.

The reason why is that junk bonds and stocks are closely affiliated in the pecking order of creditors in case of default. The rank of junk bonds is only slightly higher than equities because debt involves a contract.

Given these two markets are usually correlated, it’s worth paying attention when a divergence takes place. Indeed, a divergence is in the works now. In other words, while stocks have been holding up, the price of junk bonds have been trending lower for much of the year.

Is a Pension Fund Crisis Next?

Many public pensions suffer from funding shortfalls. In other words, they don’t have nearly enough money to meet their obligations. More than that, investments are being made in potentially financially dangerous assets to boost returns, such as private equity.