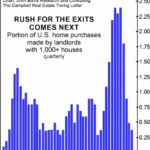

Real estate prices have reached absurdly high prices because corporate investors have taken over the housing market from individuals in a program encouraged, once again, by the federal government. “…24% of U.S. single family homes are owned by investors.” When the bulk of participants in the market are consumers who think of houses as shelter, prices are stable. When a significant portion of participants in the market are speculators who think of houses as investment items, prices soar and crash.

Update on China’s Big Housing Bust

Major red flags for the Chinese real estate market… China’s home prices are falling… Yet, economists have been dismissive of this threat.

Are You Prepared for Widespread Bank Failures?

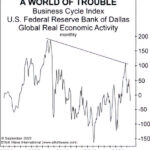

“This time, the world economy appears to be on much shakier footing”. The ideal time to prepare for almost anything in life, especially a potential circumstance that’s adverse, is before it happens. The problem is: Many people don’t know what will happen in their lives ahead of time.

However, sometimes warnings are provided yet they’re ignored or not taken seriously. A current warning from Elliott Wave International which people are urged to take very seriously is that the economic slowdown could morph into something far worse than a garden-variety recession.

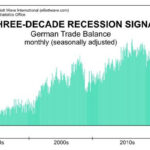

Will Another “Great Depression” Start in Europe?

Many people are concerned about the return of a recession now that the FED has been actively tightening and the market has begun falling. Other indicators are flashing signs that we are already in a recession i.e. two consecutive quarters of falling GDP. But so far the National Bureau of Economic Research (NBER) hasn’t officially declared a recession to be in progress. Although, it generally takes them a while after the fact to make the official determination of the beginning (or end) of a recession. In addition to falling GDP other factors can trigger a recession as we will see from the following article from Elliott Wave International. ~ Tim McMahon, editor

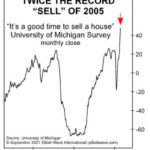

Surging Housing Prices Are Entering The Stratosphere- Look Out Below

In my Inflation-Adjusted Housing index article, I included a chart that showed recent housing prices skyrocketing not only in nominal terms but in inflation-adjusted terms as well. This means that from a historical perspective houses are more expensive than at any time since 1900! In today’s article, Elliott Wave International editors tell us why we should expect housing prices to decline.

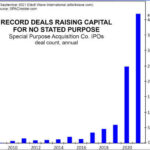

Warning: Mergers And Acquisitions Can Vaporize The Stock Market

Historically we’ve seen that when market participants become overly optimistic the market has nowhere to go except down. This is logical because at optimism peaks everyone who has any money to invest, has already invested it, so there is no one left to buy. Conversely, when pessimism reaches extremes, no one is left to sell and so the market has to go up, as brave bargain-hunters re-enter the market.

Secrets To Maintain A Healthy Trading Psychology

Two of the greatest motivators in the financial arena are Fear and Greed. Unfortunately, many traders fall victim to their enticement and end up making disastrous mistakes. But by getting your emotions under control you can follow the sage advice of Warren Buffet and “Be fearful when others are greedy and greedy when others are fearful”.

A Change May Be Nigh for Real Estate

House buyers want to buy at a favorable price, house sellers want to get the most for their property. But for the past several months — across the country — buyers have often had a tricky time finding a reasonably priced home. A recent headline says, “home prices have risen 100 times faster than usual.” And on InflationData we just updated the Inflation-Adjusted Real Estate Index adding data all the way back to 1890. We look at the idea that housing prices “always go up”.

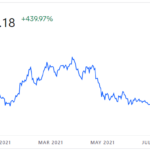

Will China’s Crackdown Send Bitcoin’s Price Tumbling?

Over the last year, bitcoin has increased by over 400%. As a matter of fact, it has more than doubled since the July low. In today’s article, we are going to look at whether news or even government actions affect the price of bitcoin. In the article, it refers to a proclamation made on July 2, where Elliottwave International says that the downtrend was ending… and then Bitcoin rose throughout July and August, fell through September (bottoming on September 28th), and then it began to rise again. ~Tim McMahon, editor.

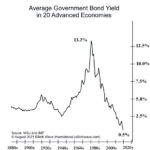

Be Prepared “Or Else”

Ever since my Boy Scout days their “motto” of “Be Prepared” has been my guiding philosophy. Buying when things are plentiful is much better than fighting the crowds when things are scarce. (Think toilet paper in 2020). Unfortunately, “hoarding” has gotten a bad name because some individuals try to buy up all the scarce supplies WHEN THEY ARE SCARCE but if you buy when they are plentiful, it isn’t hoarding… it is being prepared. And rather than being a bad thing… it is actually a good thing. Here’s why: If you have your own supply you won’t be competing with the unprepared for the scarce resources. You may even have enough to share some with your friends and neighbors. In today’s article by Elliottwave International, we’re going to look at scarcity and its companion austerity and how they relate to the cost of money. ~ Tim McMahon, editor