Most stock market investors get fooled at major price turns. Why? Because a bottom never feels like a bottom and a top never feels like a top – how many bears could you count in 2007, right before stocks tanked and the Great Recession followed? This idea was embodied by the quote attributed to Barron Rothschild, an 18th-century member of the Rothschild banking family. He said that “the time to buy is when there’s blood running in the streets.”

Capital Gains Tax Hike News: Was It REALLY to Blame for Sell-off?

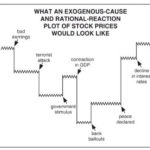

As Elliott Wave International has noted many times, the mainstream financial press always tries to find a reason for a given trading day’s stock market action.

In other words, if stocks happen to be up for the day, many financial journalists will say it was because of this or that “positive” news. If stocks happen to be down for the day, you got it, these journalists will ignore the positive news and search for something “negative” that happened in the country or world and say that was the reason stocks went down.

Repeating Patterns = Profit Potential

As shown in the charts, the S&P 500 performed quite well walking forward from February 1, 2013 and December 9. 2016, both periods are similar to December 23, 2019, which tells us to remain open to better than expected outcomes in 2020.

They Don’t Ring a Bell at Market Tops (or Bottoms)

Recently I read the following comment on a post about investing in Gold:

Isn’t buying Gold today just like buying a horse ?

It being a purely romantic move for an object with no current use.

Sure it looks pretty and it will still get you there, though slowly,

but why would anyone have it as their primary source of investment travel ?

And I got to thinking that maybe comments like that are the “Bell” that rings indicating a new buying opportunity is at hand. In response I wrote an article entitled, Where’s Gold Headed Today? At the time of the comment, Gold had just finished trading at $1050 and by the time I wrote the article, gold was trading at $1100. As of this writing gold is trading at $1220. So it appears that the commentor made it statement at the precise bottom. But then gold tends to be an “emotional” investment with crazy statements at both the bottom and top. Personally, I think these outlandish comments are more reliable if they come from the general public rather than from seasoned investors.

I remember attending a seminar for computer network professionals in early 2000 and during every break all they could talk about was how they were going to retire on their 401k stock gains which exceeded their salaries. There’s an old saying that “It’s time to sell when the bag boy at the grocery store is giving you stock tips”. Although these guys weren’t “bag boys” they certainly weren’t investing pros either.

In the following article Chris Ciovacco gives us a different perspective about market sentiment… and gives us this excellent reminder… “Sentiment, like many pieces of evidence can be helpful, but like anything else it should not be used in isolation.” ~Tim McMahon, editor

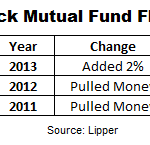

Have All the “Buyers” Already Bought?

In a Bull market that is appreciating sharply, greed begins to take over and people begin speculating with money they can’t afford to lose. Logic would dictate that when it gets extremely bullish everyone who is going to buy has already bought and so with no one left to buy the market falls. And when the market falls […]

What is Forex News Trading?

The Forex market remains a source of great opportunity for investors, thanks primarily to its high levels of leverage and liquidity. It is a margin based investment opportunity, which enables shrewd and experienced operators to gain returns that can dramatically exceed their initial financial commitment. But it also brings considerable risk, however, as less fortunate traders […]

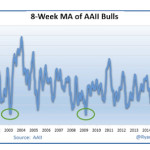

Market Sentiment Analysis: Spotting a Shift in Sentiment is Key

Don’t follow the crowd- By analyzing market sentiment astute traders can spot subtle shifts ahead of the crowd in order to open the floodgates to massive profits. We’ve all heard the old mantra “Buy Low, Sell High” but logically that means that we have to buy when everyone else is selling or better yet, after everyone […]