In today’s video Jeffrey Kennedy explains the basics of Elliott Wave analysis. The first distinction is between “motive” and “corrective” waves. Motive waves provide the majority of the movement while as the name implies corrective waves “correct” or take back a portion of the move made by the primary motive wave.

Motive waves can be further subdivided into two types i.e. impulse waves (five waves) and ending diagonals (rising or falling diagonals).

The primary focus of this lesson is the corrective portion of the pattern. The first two types are comprised of 3 waves called “A”, “B”and “C” while the third type actually has 5 waves “A”, “B”, “C”, “D” and “E”.

The primary focus of this lesson is the corrective portion of the pattern. The first two types are comprised of 3 waves called “A”, “B”and “C” while the third type actually has 5 waves “A”, “B”, “C”, “D” and “E”.

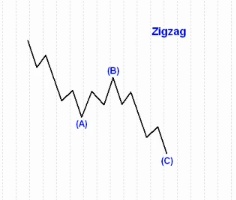

The ZigZag

The first type of corrective wave is the “ZigZag” or 5-3-5 pattern. As you can see in the diagram wave “A” consists of 5 waves down followed by wave “B” which is 3 waves up and wave “C” is another 5 waves down. Typically in this type of pattern we see wave “C” equal in distance to wave “A”.

The Flat

The Flat

The next type of pattern Jeffrey will look at is called the “Flat” in this pattern we see a 3-3-5 pattern. In this pattern wave “B” ends at or near the start of wave “A”. Wave “C” is 5 waves and terminates beyond the end of wave “A”.

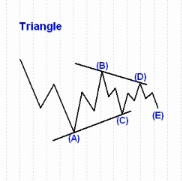

The Triangle

The Triangle

He will also discuss the “Triangle” pattern. The chart to the left is called a “contracting triangle” and that is the most common form. It is composed of 5 waves “A”, “B”, “C”, “D” and “E”. Each of these waves are comprised of 3 smaller waves. Triangles can only form under certain circumstances such as during a wave “4”, wave “B”, or wave “X”.

Get 10 FREE Lessons on The Elliott Wave Principle that Will Change the Way You Invest Forever >>

Learn the Basics of Corrective Waves– Video

Senior Analyst Jeffrey Kennedy outlines three important Elliott wave patterns in three markets

By Elliott Wave International

See how three Elliott wave patterns develop — in Cliffs Natural Resources Inc (CLF), iShares Russell 2000 Index (IWM) and Direxion Daily Financial Bull 3X Shares (FAS) — in this 5-minute video excerpt from Jeffrey Kennedy’s Trader’s Classroom service. Click to learn more about Trader’s Classroom.

|

If you are prepared to take the next step in educating yourself about the basics of the Wave Principle — access the FREE Online Tutorial from Elliott Wave International.The Elliott Wave Basic Tutorial is a 10-lesson comprehensive online course with the same content you’d receive in a formal training class — but you can learn at your own pace and review the material as many times as you like!Get 10 FREE Lessons on The Elliott Wave Principle that Will Change the Way You Invest Forever >> |

You might also like:

- Using Trend Lines and Identifying Support and Resistance

- Anatomy Of A Stock Market Turn

- Using a High-Confidence Elliott Wave Pattern- The Ending Diagonal

- How to Identify Turning Points in Your Charts Using Fibonacci

This article was syndicated by Elliott Wave International and was originally published under the headline Learn the Basics of Corrective Waves. EWI is the world’s largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

Speak Your Mind