Candle stick patterns are believed to be first developed by Japanese rice merchants hundreds of years ago but it wasn’t until recently that they began to catch on here in the United States. But they seem to be replacing the traditional Open, High, Low, Close (OHLC) stick figure format, perhaps because they provide a bit more information in a more graphical format. So a quick glance at a candlestick chart can give you a much better feel for the stock. Also once you get to know candlestick charting you will be able to spot patterns that are not readily visible with OHLC charting. ~Tim McMahon, editor

By Elliott Wave International

Senior Analyst Jeffrey Kennedy is the editor of Elliott Wave Junctures educational service and is a very popular instructor. Jeffrey’s primary analytical method is the Elliott Wave Principle, but he also uses several other technical tools to supplement his analysis. In today’s lesson, Jeffrey shows you how to use candlestick patterns to identify opportunities. You can apply these methods across any market and any time frame.

Senior Analyst Jeffrey Kennedy is the editor of Elliott Wave Junctures educational service and is a very popular instructor. Jeffrey’s primary analytical method is the Elliott Wave Principle, but he also uses several other technical tools to supplement his analysis. In today’s lesson, Jeffrey shows you how to use candlestick patterns to identify opportunities. You can apply these methods across any market and any time frame.

If you think you need years of experience to identify a high probability trade setup — you’re wrong.

To prove my point, let’s examine three price charts using only a few popular Japanese Candlestick patterns and a single simple moving average (SMA).

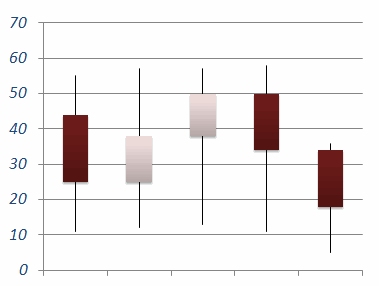

Japanese Candlestick analysis was introduced to the West by Steve Nison. The information contained in a candlestick chart is the same that is contained in an open-high-low-close chart, except that the data is presented differently using “shadows” and “real bodies.”

Moreover, these candlesticks form patterns which are important to traders. If you would like to learn more about candlesticks, I highly recommend the book Japanese Candlestick Charting Techniques by Steve Nison.

How do two tools — candlesticks and a 20-period SMA — identify high probability trade setups?

The answer is simple in that you use the 20-period SMA to identify the trend and then focus your attention on the appropriate candlestick patterns. If the trend is up, as defined by the slope of the 20-period SMA, focus your attention on bullish engulfing patterns, piercing lines and morning stars. If the trend is down, as defined by the slope of the 20-period SMA, focus your attention on bearish engulfing patterns, dark cloud cover patterns and evening stars.

Watch this 4-minute video where I explain more:

This article was syndicated by Elliott Wave International and was originally published under the headline How to Find Trading Opportunities in ANY Market Using Candlesticks (Video). EWI is the world’s largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

[…] How to Find Trading Opportunities in ANY Market Using Candlesticks (Video) […]