Fundamental And Technical Alignment?

From a probability perspective, the best investment ideas tend to be those with improving fundamentals and improving technicals (charts). On the fundamental side, the news has been improving for homebuilders. From Fox Business:

From a probability perspective, the best investment ideas tend to be those with improving fundamentals and improving technicals (charts). On the fundamental side, the news has been improving for homebuilders. From Fox Business:

D.R. Horton Inc, the largest U.S. homebuilder, reported better-than-expected quarterly revenue and said orders jumped 38 percent, suggesting an uptick in housing demand. The company, which caters to people buying their first or second homes, said the number of homes sold rose 25 percent to 8,612 in the fourth quarter ended Sept. 30.…Luxury homebuilder Toll Brothers Inc said on Monday its orders jumped in terms of both dollars and units for the first time in four quarters.

From Laggard To Leader?

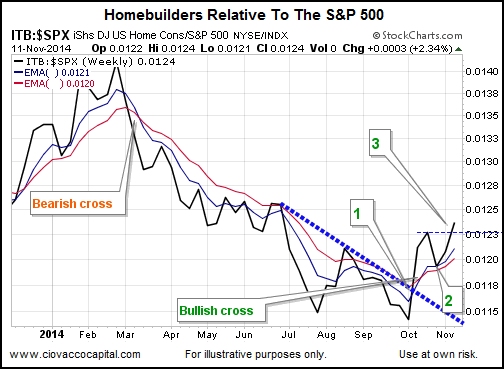

The weekly chart below shows the performance of homebuilders relative to the S&P 500 Index. The trend turned against homebuilders in early March 2014. Since the October low in stocks, rather than lagging, homebuilders have been leading. The three steps required for a bullish trend change are nearing completion: (1) a break of a trendline, (2) a higher low, and (3) a higher high. The weekly higher high does not officially go into the books until this Friday, meaning homebuilders still have some work to finish.

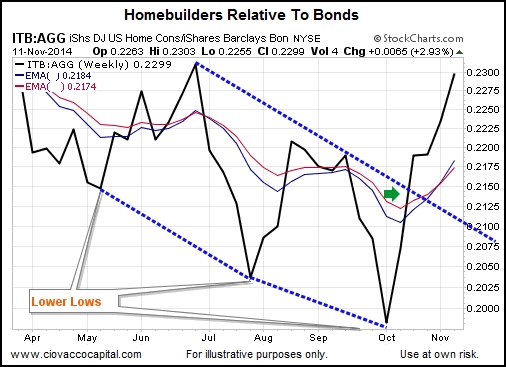

Similar improvement can be seen when comparing the performance of homebuilders to a basket of bonds (AGG).

Similar improvement can be seen when comparing the performance of homebuilders to a basket of bonds (AGG).

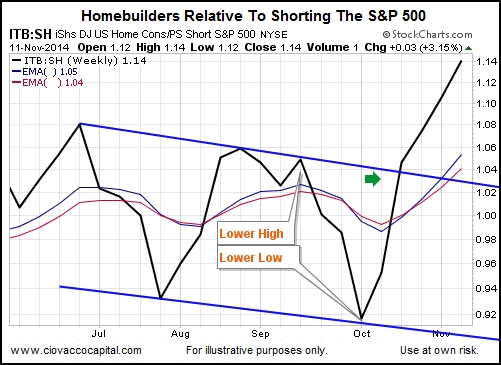

We would hope that investing in homebuilders would be better than a strategy to short the S&P 500 (SH). Until recently, that was not the case as the ITB:SH ratio was making a series of lower highs and lower lows (see chart below). The trend is trying to turn in the favor of homebuilders.

We would hope that investing in homebuilders would be better than a strategy to short the S&P 500 (SH). Until recently, that was not the case as the ITB:SH ratio was making a series of lower highs and lower lows (see chart below). The trend is trying to turn in the favor of homebuilders.

How Do We Use All This?

Investing is about probabilities. The improving fundamental and technicals in the housing sector tell us the odds of success in that sector are also improving. It should be noted that even if the weekly trends continue and homebuilders lead, that does not remove normal retracements and pullbacks from the equation. The odds of good things happening in homebuilders are better today than they were in early October. From a bigger picture perspective, the improvements in the market’s tolerance for risk outlined on October 31 and November 7 still apply.

You might also enjoy:

- Top Approaching in Berkshire Hathaway?

- A Rational Look At Stock Market Risk

- How to Find Trading Opportunities in ANY Market

- Beware of Flashy Stock Repurchases When The Market Is on The Rise

This article is Copyright © 2014 Ciovacco Capital Management, LLC. and originally appeared here and is reprinted by permission.

Speak Your Mind