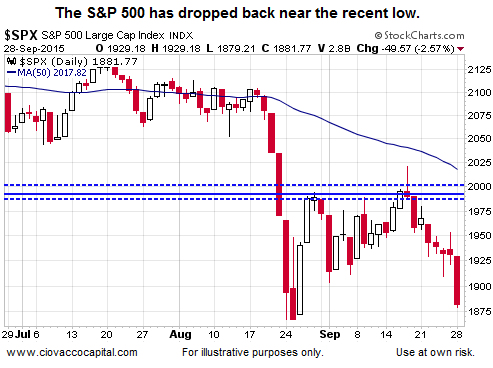

No Improvement So Far

Given the severity of the selloff in stocks in late August, it was not surprising to see the subsequent rally attempts fail. As we noted numerous times in recent weeks, including September 3 and September 17, bottoms tend to be a process.

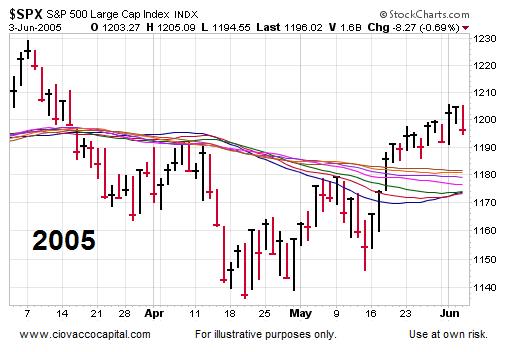

Retests Take Many Forms

The expression “retest of the lows” covers numerous market scenarios, including the historical cases shown below when a higher low was made. A retest can stay above the recent low, hit the recent low, or exceed the recent low. The key is we need to see evidence of a sustainable turn on our time-frame; something that has not happened over the past few weeks.

Does The Big Picture Support An Imminent Low?

This week’s video looks at reasonable downside targets for the S&P 500 (SPY), which helps put some more context around the “retest” subject.

Few New Hints On Monday

There was very little in Monday’s session that said “today is the final low”. For example, the VIX “fear index” held on to most of Monday’s gains into the close. The chart of the VIX below has shown some renewed improvement in recent days.

The S&P 500 (VOO) also closed near the session low, with long-term Treasuries (TLT) closing near the session high, which is a “fear” look, rather than an “imminent and sustainable bottom” look. Monday’s volume on SPY was above average (in contrast to many recent green days when SPY volume was below average).

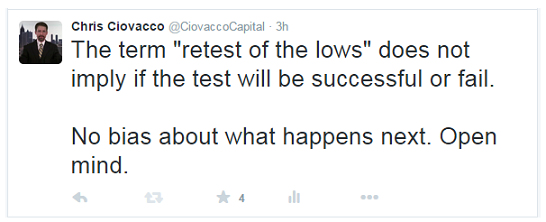

Retest Is Not A Prediction

Experience says it remains important to keep an open mind about all outcomes (bullish and bearish). The term retest can bring some bias to the table if we are not careful.

Investment Implications – The Weight Of The Evidence

Could stocks post a green day Tuesday? Sure, green days occur all the time during downtrends. We want to see evidence of a sustainable turn. That evidence can begin to surface at anytime, but under our approach we need to see it rather than anticipate it. Therefore, we continue to maintain a defensive-oriented allocation.

Copyright © 2014 Ciovacco Capital Management, LLC. All Rights Reserved. Chris Ciovacco is the Chief Investment Officer for Ciovacco Capital Management, LLC (CCM). Terms of Use. This article contains the current opinions of the author but not necessarily those of CCM. The opinions are subject to change without notice. This article is distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product.

Speak Your Mind