Recently I read the following comment on a post about investing in Gold:

Isn’t buying Gold today just like buying a horse ?

It being a purely romantic move for an object with no current use.

Sure it looks pretty and it will still get you there, though slowly,

but why would anyone have it as their primary source of investment travel ?

And I got to thinking that maybe comments like that are the “Bell” that rings indicating a new buying opportunity is at hand. In response I wrote an article entitled, Where’s Gold Headed Today? At the time of the comment, Gold had just finished trading at $1050 and by the time I wrote the article, gold was trading at $1100. Gold peaked at $1262 a few days ago and as of this writing gold is trading at $1220. So it has backed off a bit from the recent peak and it could retest the lows…

But at this point, it appears that the commentor made his statement at the precise bottom. But then gold tends to be an “emotional” investment with crazy statements at both the bottom and top. A few years ago, these same guys were talking about gold going to $5,000/oz. Personally, I think these outlandish comments are more reliable if they come from the general public rather than from seasoned investors.

I remember attending a seminar for computer network professionals in early 2000 and during every break all they could talk about was how they were going to retire in a couple of years on their 401k stock gains which exceeded their salaries. There’s an old saying that “It’s time to sell when the bag boy at the grocery store is giving you stock tips”. Although these guys weren’t “bag boys” they certainly weren’t investing pros either.

In the following article Chris Ciovacco gives us a different perspective about market sentiment… and gives us this excellent reminder… “Sentiment, like many pieces of evidence can be helpful, but like anything else it should not be used in isolation.” ~Tim McMahon, editor

Is Extreme Bearish Sentiment A Reason To Buy?

By Chris Ciovacco

Sentiment Can Be Helpful Near Extremes

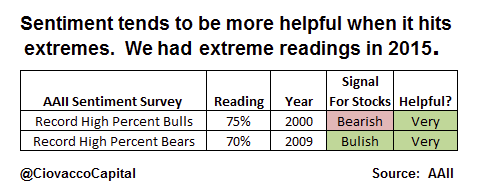

When investor sentiment reaches extreme levels, it can be a contrary indicator for the stock market. For example, the highest bullish reading in the history of the American Association Of Individual Investors (AAII) Sentiment Survey was 75% bulls before the dot-com bubble popped in 2000. To give you a reference point, the average over the life of the AAII survey is 39% bulls. Sentiment readings can also be helpful when they reach extreme levels of skepticism, which is the topic we will explore in more detail below and tie it into the present day.

Was Sentiment Helpful In Late July 2015?

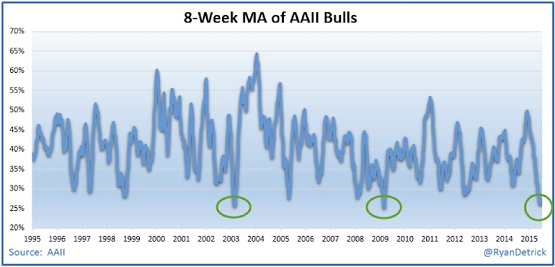

In July 2015, the eight-week moving average for percent bulls in the AAII Sentiment Survey dropped to an extremely low level, a level seen only two other times since 1995. The other two times were two of the best periods to invest in the last thirty years; early in 2003 and early in 2009.

What Happened Next?

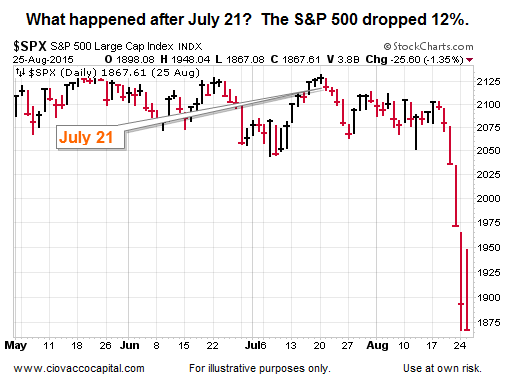

If we used extreme and rare bearish sentiment as a contrary indicator on July 21, 2015, were we rewarded with gains in the stock market? No, the S&P 500 tanked 12% between July 21 and August 25, 2015 (see chart below).

Do Longer-Term Trends Look Like They Are About To Turn Back Up?

Sentiment, like many pieces of evidence can be helpful, but like anything else it should not be used in isolation. Even under ongoing bearish conditions, stocks regularly experience green days and countertrend rallies. However, for a lasting turn to occur that allows stocks to push to new highs, markets typically show improvement on many fronts. A logical question is:

Do we have set-ups in place now that look like a sustainable turn is imminent?

You can decide after watching this week’s stock market video which covers emerging markets (EEM), Germany (EWG), foreign stocks (EFA), U.S. total stock market (VTI), energy (XLE), technology stocks (QQQ), bonds (IEF), crude oil (USO), and numerous major U.S. stock indexes (SPY).

Speak Your Mind