Next Stop: Corrective Elliott Wave Patterns

Soybeans and Apple stock (AAPL): Corrective patterns signaled opportunities in these disparate markets. Your market could be next!

By Elliott Wave International

The last 2 years have been a time of immense global adversity with the most challenging human health crisis in over a century.

But it has also been a time of immense personal growth. The uncomfortable realization of our dependence on others for everything from entertainment, education, nourishment, and income came into stark, swift focus. And with it, how quickly those things can be taken away without warning because of that dependence.

In turn, the pandemic saw an insatiable industry of online self-improvement crash courses emerge on home garden horticulture, podcast making, home building, home schooling, and — learning to trade financial markets to “ensure a steady livelihood despite economic setbacks.”

The problem is, learning to trade isn’t like learning to plant tubers in your backyard. It’s much more complicated and can’t be fully conveyed with mock “trials” or simulated positions. At best, many of such courses get people in the door, but not seated at the table of real-world practice and risk-management.

That’s where our respected partner Elliott Wave International (EWI) comes in. Its team of market analysts and technical analysis instructors has committed itself to leading the most comprehensive educational journey of the company’s 42-year long history.

EWI’s ultimate goal for 2022: Empower market newbies and veterans alike to develop and deepen their opportunity-spotting skills through the independent forecasting model known as Elliott wave analysis.

In brief, Elliott wave analysis, aka the Wave Principle, is founded on these core observations:

Market trends are driven by trends in collective investor psychology

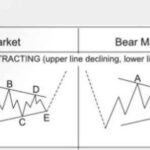

Investor psychology progresses in 2 modes, impulsive and corrective

Correctly identifying these patterns at their onset illuminates future price action

One such mode of market progress is the correction, which is best defined by the “bible” of all things Elliott, Elliott Wave Principle — Key to Market Behavior:

“Markets move against the trend of one greater degree only with a seeming struggle. Resistance from the larger trend appears to prevent a correction from developing a full motive structure… Specific corrective patterns fall into three main categories: Zigzag, flat and triangle.”