After a fairly rapid correction in January 2022, the market has started to rebound. So does that mean it’s safe to jump back into the market? After all, we saw a worse crash in January 2020 followed by a rapid rebound to new highs. And even the 2018 correction was short-lived. So have market participants become accustomed to quick rebounds? Or is this just a brief counter-trend rally?

Deflationary Psychology Versus the Fed: Here’s the Likely Winner

Most economists believe the Fed can prevent financial crises and depressions. [EWI’s analysts] disagree. Socionomic theory proposes that naturally fluctuating waves of social mood regulate financial optimism and the economy. They are unconscious and cannot be managed.

Elliott Wave: Market Signaling Fed to Cut Rates Soon

Our friends at Elliott Wave International (EWI) have been tracking the U.S. Federal Reserve’s interest rates decisions for years. This week, the Fed once again decided to keep the funds rate unchanged. But based on EWI’s analysis they expect the Fed to change course soon. They have covered this topic before, see: Want to Know […]

Has the FED Hit the Launch Button for the Stock Market?

In the following article Chris tells us how the FED has ended its tightening phase which it pursued during all of 2018 and resulted in a huge market crash in the 4th quarter.

Interest Rates Win Again as Fed Follows Market

Most economists and financial analysts believe that central banks set interest rates. For more than two decades, Elliott Wave International has tracked the relationship between interest rates set by the marketplace and interest rates set by the U.S. Federal Reserve and found that it’s actually the other way around–the market leads, and the Fed follows.

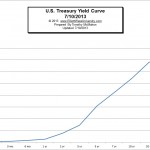

The Silver/Gold Ratio, Inflation/Deflation and The Yield Curve

The following article was written by Gary Tanashian editor of Notes From The Rabbit Hole (NFTRH) and originally appeared here. In it Gary looks at the current “Dysfunctional Market” the FED manipulation called “Operation Twist” that caused it along with Gold, Silver, plus inflation and deflation. I like his quote about the effects of inflation, “Funny money on the run… is not discriminating money. It seeks assets… period.” and he holds that that is the primary reason why the stock market has risen since 2011.

How Is The Bullish 1994 Stock Analogy Holding Up?

In today’s post Chris Ciovacco of Ciovacco Capital gives us some interesting insight into the current market situation and answers the question:

Is the Market Rallying or is it just a “counter-trend” rally?

He also discusses the three Market myths

And he has a great instructional video at the end.

The Plunge Protection Team Strikes Again

We have been expecting a major correction for quite some time now. In preparation for a market correction the index starts growing more slowly and then finally starts falling. Our NYSE Rate of Change (ROC) chart showed a slowing growth level and then generated a sell signal back in the first quarter of 2014. But […]

Fed Misstep Opens Weak Economy Door

Ben Had Just Reestablished Order After tapering comments spooked the markets in May, Ben Bernanke spent weeks trying to jawbone the markets back into a calmer state. He was successful for the most part with the S&P 500 gaining 132 points off the June low. Fed Tests Ideas In Print If you want to read […]

What is the Yield Curve and What Others Are Saying About It

What is the Yield Curve? The yield curve is a graphical representation of several “yields” or interest rates over varying contract lengths i.e. 1 month, 2 months, 3 months, 1 year, 2 years, 10 years, etc… The curve shows the relationship between the interest rate or cost of borrowing and the time to maturity. For example, interest rates paid on […]