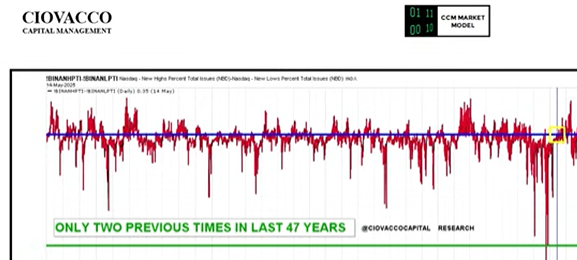

Stock Market Signal: Only 3 Times in 47 Years!

In the following video by Chris Ciovacco, Chris looks at a Stock Market Signal that has only occurred three times in the last 47 years. "Three great forces rule the world: stupidity, fear and greed." ~ Albert Einstein Chris also examines sentiment and "V"-shaped rebounds for the NYSE and NASDAQ. He reviews the market performance One, Three, Six, Nine, and Twelve months later. He also checks the NASDAQ, S&P 500, 200-day exponential moving average and much more. https://youtu.be/CWaSeJyH-Sc?si=Hfh4YYVGbxAHUlhw … [Read More...]

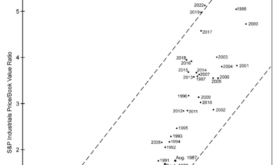

Stock Prices are Out of This World

I thought the year-end 2021 overvaluation would never be surpassed. But as you can see, the year-end 2024 reading is both higher and further to the right. It is the highest multiple ever recorded for S&P Industrials’ price to book value and the fifth-lowest level for the S&P Composite’s dividend yield, the four lower readings all occurring in 1998-2001.

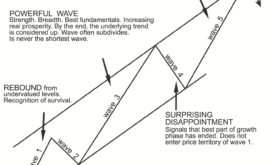

Five Benefits of Using the Elliott Wave Principle to Make Decisions

While everyone searches for the Holy Grail of forecasting, which does not exist, there is one method of analysis that stands apart from the slew of momentum-based indicators, all of which by definition lag the market. The Elliott Wave Principle is based on the concept that crowd behavior is patterned and that these patterns are easily discerned in the prices of freely traded markets. This alone sets it apart in the world of technical analysis.

Invest Like Warren Buffet

Warren Buffett now owns more T-bills than the Federal Reserve.

It’s true: Buffett’s investment firm, Berkshire Hathaway, owns $235 billion worth of T-bills; the Fed owns $195 billion worth. Of course, most of the Fed’s money is in other government-guaranteed debt. Buffett’s is mostly in stocks. Still, his current cash holdings are about twice the average for the previous five years. How did he accumulate so much cash? By selling stocks in this heady environment.

Is a China-Taiwan Conflict Likely? Watch the Region’s Stock Market Indexes

By Mark Galasiewski | Elliott Wave International The U.S. government in early May sanctioned 300 Chinese entities for supplying machine tools and parts to Russia for its war against Ukraine, while in mid-May Russian president Vladimir Putin made a … [Read More...]

What New York City’s Art Auctions Tell You About the Stock Market — and Social Mood

By Peter Kendall | Chief Analyst for U.S. Markets and Cultural Trends The fall and spring auctions in New York City are the art market's bellwether sales events. And according to The New York Times, the results from the City's spring art auction … [Read More...]

Bob Prechter on the Rich Dad Radio Show

"Are stocks REALLY overvalued?" -- "Are interest rates REALLY going to fall?" -- "Who's going to win the White House in November, Biden or Trump?" -- "What are SAFEST ways to invest right now?" These are the types of questions investors are … [Read More...]

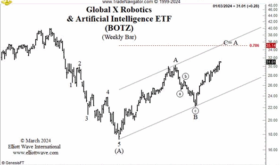

A.I. Revolution and NVDA: Why Tough Going May Be Ahead

"These things could get more intelligent than us" By Elliott Wave International The topic with all the buzz these days is Artificial Intelligence (AI) and its future. The potential benefits include automating repetitive tasks, enhancing … [Read More...]