U.S. Dollar: What to expect in 2026

Last February, Elliott Wave International’s Senior Currency Analyst, Michael Madden, warned his subscribers to expect dollar weakness in 2025. And that’s exactly what happened! So, what is Michael anticipating for 2026? You can find out now — for free. In a recent live session, Madden revealed his 2026 outlook for the greenback. In 16 minutes, he guides you through the long-term Elliott wave patterns in USD. You’ll see what’s likely next and the key levels you need to know. This presentation is FREE for a limited time from our friends at EWI. Whether you’re a forex trader or an investor, this video is a must-see. Watch Michael Madden’s U.S. Dollar Outlook 2026 now >> Who is Elliott Wave International? EWI is the world’s largest independent technical analysis firm. Founded by Robert Prechter in 1979, EWI helps investors and traders to catch market opportunities and avoid potential pitfalls before others even see them coming. Their unique perspective and … [Read More...]

This Forecasting Tool Nailed the S&P Turns

It’s not easy to forecast the twists and turns in the S&P 500 — but this video shows how the EWAVES engine did exactly that.

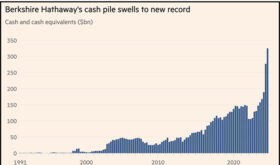

Warren Buffett isn’t buying — and that says a lot.

Berkshire Hathaway is sitting on record cash! From @elliottwaveintl: “Buffett could buy up all shares of 476 companies in the S&P 500 at present prices.”

Is Buffett quietly warning that the market is overpriced?

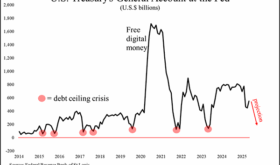

Debt Ceiling Drama

What’s another few trillion dollars? U.S. debt is already approaching a historic $37 trillion and now, Congress is discussing adding at least another $3 trillion to the “debt ceiling.” Yes, that’s the phrase that many hear on the news but know little about. Our June Global Rates & Money Flows sheds some historic light on the topic:Get ready for a summer of apprehension in America as the financial markets fixate on the level of U.S. Federal government debt and whether lawmakers allow the legal limit on it to be (once again) raised. What is the “debt ceiling” and does it really matter?

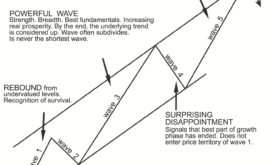

Five Benefits of Using the Elliott Wave Principle to Make Decisions

By Elliott Wave International While everyone searches for the Holy Grail of forecasting, which does not exist, there is one method of analysis that stands apart from the slew of momentum-based indicators, all of which by definition lag the market. … [Read More...]

Invest Like Warren Buffet

One would think that investors would be emulating their #1 hero. One would be wrong. By Elliott Wave International- Warren Buffett recently acknowledged that he's playing in overtime in this thing we call life. At 93, the acclaimed investor is … [Read More...]

Elliott Wave Analysis of Bitcoin

Today we have an in-depth Elliott Wave analysis of the Bitcoin Chart from Crypto Unplugged. This excellent analysis looks at several ways to determine a potential top for Bitcoin and where we currently are in the cycle. The First analysis uses … [Read More...]

Is a China-Taiwan Conflict Likely? Watch the Region’s Stock Market Indexes

By Mark Galasiewski | Elliott Wave International The U.S. government in early May sanctioned 300 Chinese entities for supplying machine tools and parts to Russia for its war against Ukraine, while in mid-May Russian president Vladimir Putin made a … [Read More...]