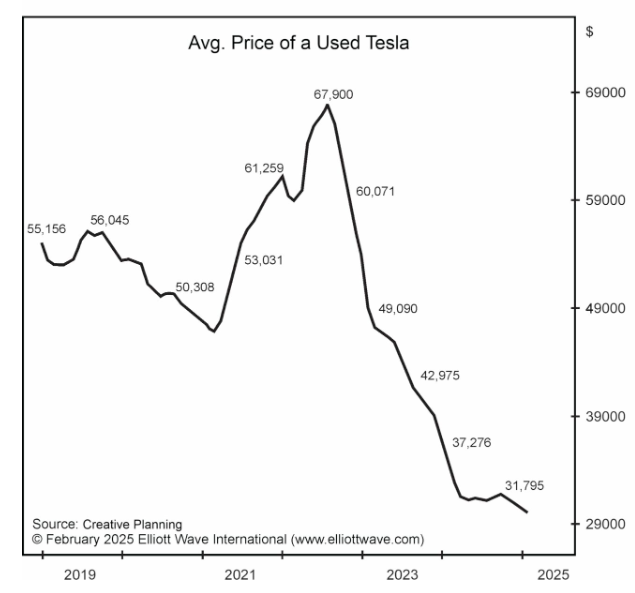

Tesla’s Troubles — Is it Musk or is it More?

By Elliott Wave International Tesla tumbled 15% on March 10, its biggest single-day drop in over five years. Elliott Wave International's March Global Market Perspective provides this insight: The world's richest man, Elon Musk, is also more vulnerable than most people realize. In March 2023, when a poll by Heatmap News, a website that focuses on climate news, showed that prospective electric-vehicle buyers were less likely to buy a Tesla due to Musk's behavior, the Global Market Perspective argued that his persona is so "attached to a bull market that even small shifts in social mood can damage his public cachet irreparably." Tesla's stock price has made no net progress since January 2021 and is down 42% from its all-time high in December 2024. In January, Germany's Federal Motor Transport Authority reported that just 1,300 new Teslas were registered, the lowest monthly total since July 2021. Across Europe's three largest electric vehicle markets- Germany, France, and Britain- … [Read More...]

Five Benefits of Using the Elliott Wave Principle to Make Decisions

While everyone searches for the Holy Grail of forecasting, which does not exist, there is one method of analysis that stands apart from the slew of momentum-based indicators, all of which by definition lag the market. The Elliott Wave Principle is based on the concept that crowd behavior is patterned and that these patterns are easily discerned in the prices of freely traded markets. This alone sets it apart in the world of technical analysis.

Invest Like Warren Buffet

Warren Buffett now owns more T-bills than the Federal Reserve.

It’s true: Buffett’s investment firm, Berkshire Hathaway, owns $235 billion worth of T-bills; the Fed owns $195 billion worth. Of course, most of the Fed’s money is in other government-guaranteed debt. Buffett’s is mostly in stocks. Still, his current cash holdings are about twice the average for the previous five years. How did he accumulate so much cash? By selling stocks in this heady environment.

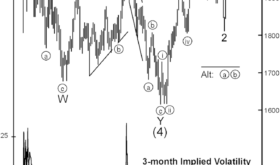

Gold Prices: The calm before a record run

Gold’s three-month implied volatility has declined to its lowest level in over four years. While low volatility is not a short term timing tool, low volatility eventually precedes high volatility. At the same time, total open interest in gold futures has declined to its lowest level since December 2018, as traders are either closing futures contracts or abstaining from opening new ones. The low level of open interest means that investors’ attention is turning away from gold, and the low implied volatility indicates that investors do not expect gold to move much over the course of the next three months. Both are preludes to what we see as a major move forming in gold prices.

What New York City’s Art Auctions Tell You About the Stock Market — and Social Mood

By Peter Kendall | Chief Analyst for U.S. Markets and Cultural Trends The fall and spring auctions in New York City are the art market's bellwether sales events. And according to The New York Times, the results from the City's spring art auction … [Read More...]

Why You Should Pay Attention to This Time-Tested Indicator Now

"How High Can Markets Go?" -- asks this magazine cover By Elliott Wave International Paul Montgomery's Magazine Cover Indicator postulates that by the time a financial asset makes it to the cover of a well-known news weekly, the existing trend has … [Read More...]

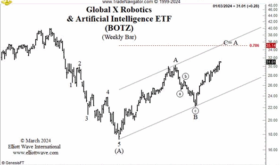

A.I. Revolution and NVDA: Why Tough Going May Be Ahead

"These things could get more intelligent than us" By Elliott Wave International The topic with all the buzz these days is Artificial Intelligence (AI) and its future. The potential benefits include automating repetitive tasks, enhancing … [Read More...]

Free report: ‘Gold Investors’ Survival Guide’

Dear reader, Gold prices are breaking records -- and you want to know what's next. So, our friends at Elliott Wave International have created a practical (and free) guide to help you get on the right track fast. In "Gold Investors' Survival … [Read More...]