In the following article, the editors at Elliott Wave International look at the correlation between disease outbreaks and market behavior. Initially, COVID caused the market to tank but it wasn’t long before we saw a swift rebound. So, how do disease outbreaks correlate? Are they market indicators? Read this article to find out. ~Tim McMahon, editor

How to Outwit 99% of Investment Pros

Was COVID-19 a “bullish event”? No. Here’s the real answer why stocks rose as the pandemic raged.

By Elliott Wave International

Waves of social mood fluctuate in accordance with the Wave Principle and determine prices in financial markets. Moreover, these same waves regulate the tenor and character of social attitudes and actions. The key point is that social mood is the cause. It is endogenous. Prices in financial markets and events in society are the effects. They are exogenous.

However, most people believe the opposite is true.

For example: Most people believe that recessions cause business people to be more cautious. However, Elliott Wave International posits that cautious businesspeople cause recessions.

Or, consider the widespread notion that scandals make people outraged. In truth, outraged people seek out scandal. Consider that when the mood is positive, fodder for scandal is often dismissed. You can also flip around the notion that nuclear bomb testing makes people nervous and say that nervous people test nuclear bombs.

Here’s another example: Many observers believe that a rising stock market makes investors increasingly optimistic. However, the evidence suggests that optimistic investors cause stock market prices to rise (and pessimistic investors cause market prices to fall).

Elliott Wave International’s Asian-Pacific analyst, Mark Galasiewski, drove the point home further when he said this at the Chartered Market Technician Association’s Asia-Pacific Summit in October:

If you were able to make that one counterintuitive leap that the same endogenous mass psychological swings that create patterns in the stock market also drive other headline social events, then you have already won half the battle in the market and you understand stock market movements better than 99% of industry professionals.

Social mood swings from extreme optimism to extreme pessimism and back again.

By the time that these social mood trends show up as major news or events (positive or negative), that’s when the pendulum is set to start swinging in the other direction.

Recessions, scandals, nuclear testing, and so on were mentioned as examples of what may occur during negative mood trends.

Let’s add epidemics to that list. Yes, Elliott Wave International has observed a relationship between bear markets and infectious disease.

Using this knowledge, the April 3, 2020, Global Market Perspective, a monthly Elliott Wave International publication that covers 50+ worldwide financial markets, said:

Asian-Pacific and emerging market stocks began bull markets amid the SARS epidemic of 2003 and the Swine Flu epidemic of 2009. They should similarly embark on a bull market amid the Covid-19 pandemic of 2020.

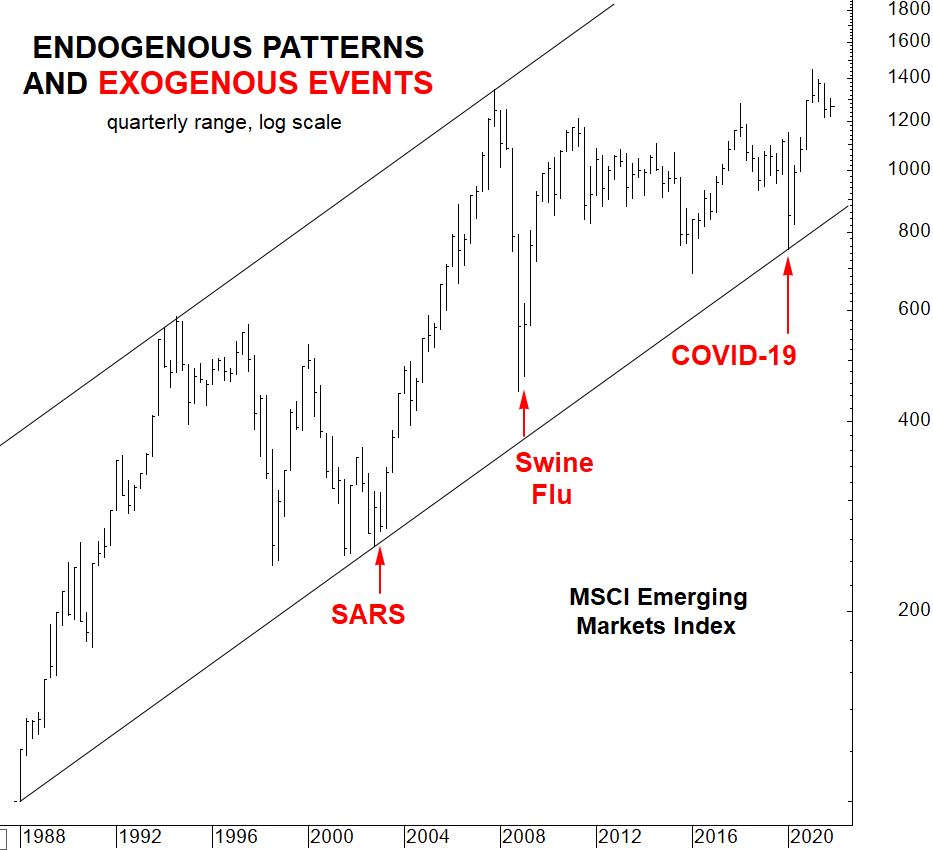

Indeed, look at this MSCI Emerging Markets Index chart which Mark Galasiewski showed at that Asia-Pacific Summit previously mentioned:

As you can see, an uptrend did ensue amid Covid-19.

However, it would be wrong to say that epidemics are bullish for the stock market. That’s the “exogenous” thinking trap that was discussed above. A proper way to think about it is that when social mood is at its lowest, epidemics are more likely. That’s why they have so often marked a bottom, not a top. As Mark said:

Notice that these three major infectious diseases spread widely toward the end of major bear markets.

This is invaluable information for any investor. Imagine having this knowledge back in March 2020, when the first wave of the pandemic hit and everyone panicked!

If you would like to dig deeper into the “endogenous patterns” of the Wave Principle, you are encouraged to read the Wall Street classic, Elliott Wave Principle: Key to Market Behavior, by Frost & Prechter.

Here’s a quote from the book:

The Wave Principle is governed by man’s social nature, and since he has such a nature, its expression generates forms. As the forms are repetitive, they have predictive value.

Get insights into the “predictive value” of the Wave Principle by reading the online version of the book — entirely free!

The only requirement for free access is a Club EWI membership. Club EWI is the world’s largest Elliott wave educational community and is free to join. Members are under no obligations. Yet, members do enjoy complimentary access to a wealth of Elliott wave resources on financial markets, investing and trading.

Follow this link for free and unlimited access to the book: Elliott Wave Principle: Key to Market Behavior.

Other Socionomic Artice You Might Like:

- Socionomics and the Misery Index

- The Investor’s Battle Between Hope and Fear

- Rise of the “Know Nothings”

- Deflationary Psychology Versus the Fed: Here’s the Likely Winner

- Want to See What’s Next for the Economy? Try This.

- Are Falling Oil Prices Really Good for the Stock Market?

- The Disruptive New Science that Shatters Today’s Investing Paradigm

- Non-Traditional View of the Markets

This article was syndicated by Elliott Wave International and was originally published under the headline How to Outwit 99% of Investment Pros. EWI is the world’s largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

Speak Your Mind