Ever since my Boy Scout days their “motto” of “Be Prepared” has been my guiding philosophy. Buying when things are plentiful is much better than fighting the crowds when things are scarce. (Think toilet paper in 2020). Unfortunately, “hoarding” has gotten a bad name because some individuals try to buy up all the scarce supplies WHEN THEY ARE SCARCE but if you buy when they are plentiful, it isn’t hoarding… it is being prepared. And rather than being a bad thing… it is actually a good thing. Here’s why: If you have your own supply you won’t be competing with the unprepared for the scarce resources. You may even have enough to share some with your friends and neighbors.

The old saying “get while the getting’s good” applies to today’s situation. We can find most items on the shelves and people still have the money to buy stuff. But If interest rates rise that may not be the case in the near future. In today’s article by Elliottwave International, we’re going to look at scarcity and its companion austerity and how they relate to the cost of money. ~ Tim McMahon, editor

Prepare Now for a Brutal Austerity — Here’s Why

Here’s what’s holding together a “global house of cards”

By Elliott Wave International

When financial times get tough, you hear the phrases “tightening our belts,” “cutting back” or “making do with less.” Those are common phrases to describe the word “austerity.” If spending and borrowing had been done with moderation when times were good, then the tough times would not be as tough — or austere.

Instead of “moderation,” the best word to describe what’s going on in the U.S. now is “excessive,” as these headlines attest:

- Consumers boost spending in June (Marketwatch, July 30)

- Corporate Debt Is Ballooning (Forbes, August 4)

- A blowout in government borrowing … (Bloomberg, August 19)

Individuals, corporations, and governments find it difficult to be financially frugal when interest rates are exceptionally low.

Here’s what the August Global Market Perspective, a monthly Elliott Wave International publication that covers 50+ worldwide financial markets, has to say:

We have little doubt that it will take a long period of austerity to correct the world’s multigenerational debt binge. …

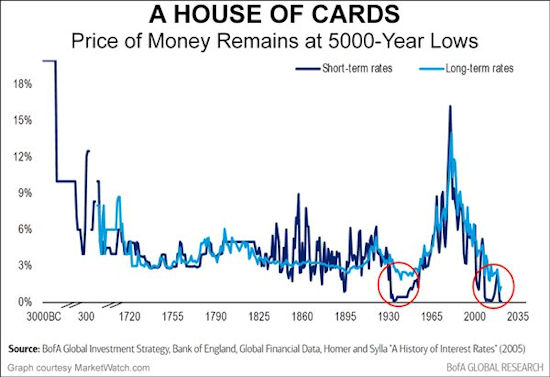

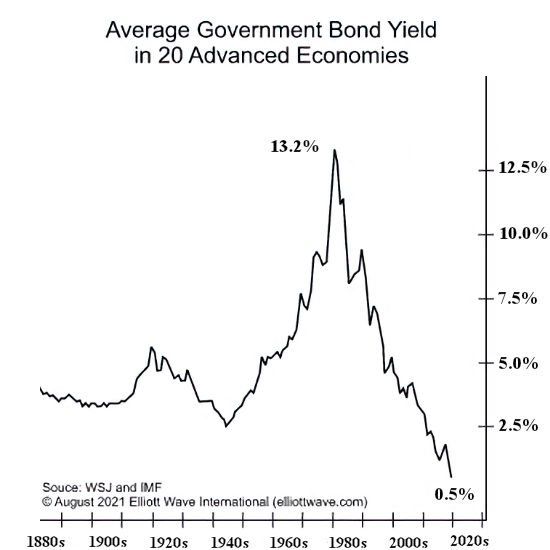

The chart illustrates the interest-rate environment that holds together this global house of cards. In July, the average interest rate across 20 [advanced] economies fell to 0.5%, a new low (by far) dating back at least a century.

Indeed, according to at least one source, rates are as low as they’ve been in 50 centuries (5000 years).

Let’s return to the August Global Market Perspective:

Interest Rates aka. the Cost of Money

This chart is a version of one published by Sidney Homer and Richard Sylla in their 2005 book: A History of Interest Rates. Astoundingly, it shows a potential 5,000-year low in both short-term interest rates and long-term interest rates.

When interest rates start to rise, and it becomes difficult to service debt, a brutal austerity will be the order of the day.

As you might imagine, the best course of action — especially at this juncture — is to refrain from assuming debt and to save as much cash as possible. When austerity reigns, cash will be king.

Another course of action is to learn what the Elliott wave model suggests is next for interest rates (or bond yields).

If you need to brush up on your knowledge of the Elliott wave model or are new to the subject, you are encouraged to read the Wall Street classic, Elliott Wave Principle: Key to Market Behavior, by Frost & Prechter. Here’s an excerpt from the book:

What the Wave Principle provides is a means of first limiting the possibilities and then ordering the relative probabilities of possible future market paths. Elliott’s highly specific rules reduce the number of valid alternatives to a minimum. Among those, the best interpretation, sometimes called the “preferred count,” is the one that satisfies the largest number of guidelines. Other interpretations are ordered accordingly. As a result, competent analysts applying the rules and guidelines of the Wave Principle objectively should usually agree on both the list of possibilities and the order of probabilities for various possible outcomes at any particular time. That order can usually be stated with certainty. Do not assume, however, that certainty about the order of probabilities is the same as certainty about one specific outcome. Under only the rarest of circumstances do you ever know exactly what the market is going to do. You must understand and accept that even an approach that can identify high odds for a fairly specific event must be wrong some of the time.

You can prepare yourself psychologically for such outcomes through the continual updating of the second-best interpretation, sometimes called the “alternate count.” Because applying the Wave Principle is an exercise in probability, the ongoing maintenance of alternative wave counts is an essential part of using it correctly. In the event that the market violates the expected scenario, the alternate count puts the unexpected market action into perspective and immediately becomes your new preferred count. If you’re thrown by your horse, it’s useful to land right atop another.

Here’s the good news: You can access the online version of the book for free when you join Club EWI — the world’s largest Elliott wave educational community (approximately 350,000 worldwide members and rapidly growing).

You can join Club EWI for free and enjoy access to a wealth of Elliott wave resources on financial markets, trading and investing. All the while, you are under no obligations as a Club EWI member.

You can have the book on your computer screen in just a few minutes by following this link: Elliott Wave Principle: Key to Market Behavior — unlimited and free access.

You might also like:

- Safe-Haven Investments that Protect Your Capital From Rising Inflation

- The Relationship Between Inflation and Interest Rates: Explained

- Inflation and Bonds

- 9 Inflation Books You Must Read

This article was syndicated by Elliott Wave International and was originally published under the headline Prepare Now for a Brutal Austerity — Here’s Why. EWI is the world’s largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

Speak Your Mind