Most economists believe the Fed can prevent financial crises and depressions. [EWI’s analysts] disagree. Socionomic theory proposes that naturally fluctuating waves of social mood regulate financial optimism and the economy. They are unconscious and cannot be managed.

Deflation: The Trend That’s Become Too Obvious To Ignore

As the biggest credit bubble in history continues to shrink, consumer prices have stayed flat over the past several months, meaning there is no sign of inflation to come, despite growing commitments from the U.S. government. So what’s keeping inflation at bay, given all the stimulus money promised? The answer: Deflation — an overwhelming urge […]

20 Questions with Robert Prechter: Signs Point to Deflation

The following article is an excerpt from Elliott Wave International’s free report, 20 Questions With Deflationist Robert Prechter. It has been adapted from Prechter’s June 19 appearance on Jim Puplava’s Financial Sense Newshour. To read the entire conversation, access the 20-page report here. Jim Puplava: Bob, I want to pick up from last September. Since […]

Deflation: How To Survive It

The M3 money supply in the U.S. is contracting fast, and deflation is suddenly in the news again. It’s a good moment to catch up on a few definitions, as well as strategies on how to beat this rare economic condition. And who better to ask than EWI’s president Robert Prechter? Here’s a free excerpt from a collection of his most important essays on deflation.

Signs of Deflation You Might Not be Able to See Clearly

Most people assume that they are investing in an inflationary world, because that’s what the Fed tells them it’s worried about. But deflationary forces continue to loom even though they are not so visible. Here are five that you might not be able to see clearly.

Bob Prechter Points Out The Many Signs Of Deflation

Everywhere you look, the mainstream financial experts are pinning on their ‘WIN 2’ buttons in a show of solidarity against what they see as the number one threat to the U.S. economy: Whip Inflation Now. There’s just one problem: They’re primed to fight the wrong enemy. In a special report, Bob Prechter uncovered the ‘Continuing and Looming Deflationary Forces’ underway right now.

Market Myths Exposed: Inflation Is Not A Threat, Deflation Is

Most people are confident they can recognize a myth when they hear one: Wearing a hat causes baldness; eating a bunch of carrots gives you perfect vision; ‘light’ cigarettes are better for your health than the regular kind. But what about this sentence: Inflation is the number one threat to the US economy? Myth? You betcha.

You Still Believe The Fed Can Stop Deflation?

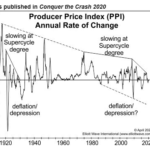

Think back to the fall of 2007. The deflationary “liquidity crunch” that over the next year-and-a-half cuts the DJIA in half, decimates commodities, real estate and world markets is only starting. Almost no one believes that the crash is coming — to a large degree, because everyone is convinced that the U.S. Federal Reserve Bank, with Ben Bernanke at the helm, will never allow deflation to happen: It can just print money! Well, take a look at these two charts EWI’s president Robert Prechter’s published in October 2007.

Take Time from March Madness for 2010’s Most Important Investment Report

You want to know whether to prepare for inflation or deflation? This report, with its 22 examples and 13 charts, will answer your questions.