Using a Triple Calendar Spread to Trade Google Earnings

One of the most useful characteristics of options is their ability to control risk and achieve a high probability of success when trading impending earnings announcements.

Google will announce third quarter earnings after the market closes on Thursday. It does not take a conspiracy theorist to recognize that the following day, Friday, is the last day to trade October options. Given this timing, options trades can be constructed with near surgical precision to reflect the trader’s hypotheses regarding the price reaction to the earnings release.

I thought it would be helpful to review some of the data that an options trader should consider prior to constructing an option trade to profit from this event and to consider some other potential trades.

First, the recent history of stock price move on earnings release must be considered. The reaction of price over the last four quarterly releases has been +8%, +7%, +2% and +3% with the two lowest numbers correlating with the two most recent earnings releases.

The second factor to consider is the information embedded in the current pricing of the options chain. The easiest way to determine the aggregate opinion of the overall option market as it relates to the expected move following the earnings release is to calculate the value of the front month at-the-money straddle discounted by roughly 15%. It is important to recognize that this value is reflective of the anticipated magnitude of the move and gives no information whatsoever on the direction.

In the case of GOOG, closing prices on Monday with GOOG trading around $740 give a value of ($19.90+20.80)*0.85 = $34.60. This equates to roughly a 5% move or a projection with a 68% probability (1 standard deviation) that the price movement will be bounded within this range.

Option positions to trade earnings can be based on two general considerations: directional or non-directional. Directional based trades can be constructed using a variety of approaches, but MUST account for the collapse of implied volatility following earnings release.

To be blunt, this means that simply buying only puts or calls in the front month series is not putting probabilities on your side. Appropriate directional constructions would include vertical spreads, butterflies, and calendars. Each of these trades either mitigates or benefits from the inevitable collapse of implied volatility immediately following the earnings release.

Playing earnings directionally is a difficult game. Recent market history is replete with unanticipated earnings misses and unforeseen earnings blow outs. For those who wish to play these announcements directionally, I feel the major value of an options approach is to control risk crisply since there will inevitably be unpredicted and unpredictable price reactions.

My preference is to use strategies that are profitable over a wide range of prices. The potential constructions in this category include iron condors and double and triple calendars. Such trades do not deliver the overwhelming returns of a correct prediction of price direction, but over a large series of trades result in a high probability of success.

The trade I would like to consider is that of a triple calendar spread. We will buy the December series options, and sell the October series with dramatically increased implied volatility as a result of the impending earnings release.

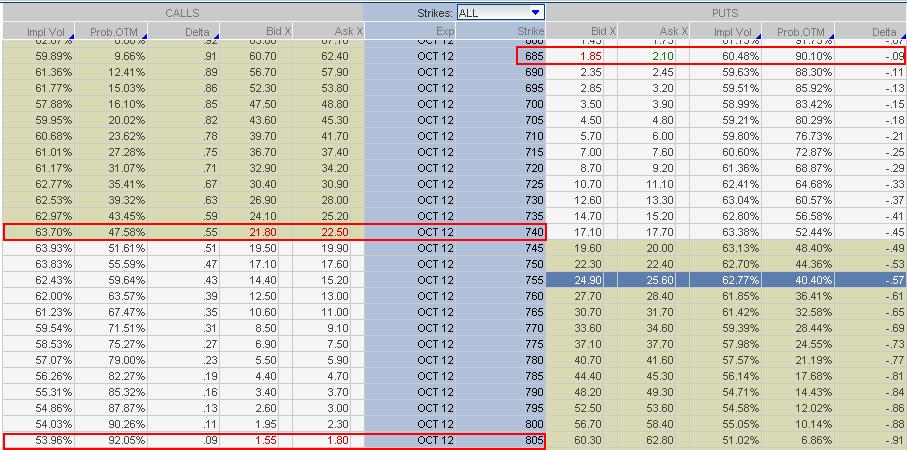

The GOOG October monthly option chain is displayed below:

The strikes highlighted above would be sold-to-open in this spread while the strikes shown below would be bought-to-open simultaneously to produce the calendar spread discussed above.

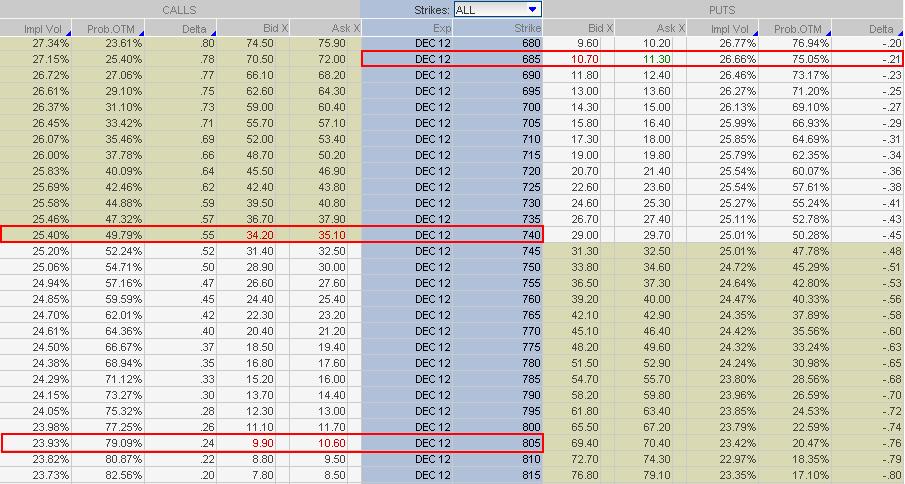

The GOOG December monthly option chain is displayed below:

Calendar spreads are usually constructed by selling the near month put or call and buying the same strike in the preceding month. In this case, note that the November options trade with substantially higher implied volatility than do the December options as a result of “bleed over” of the elevated October volatility.

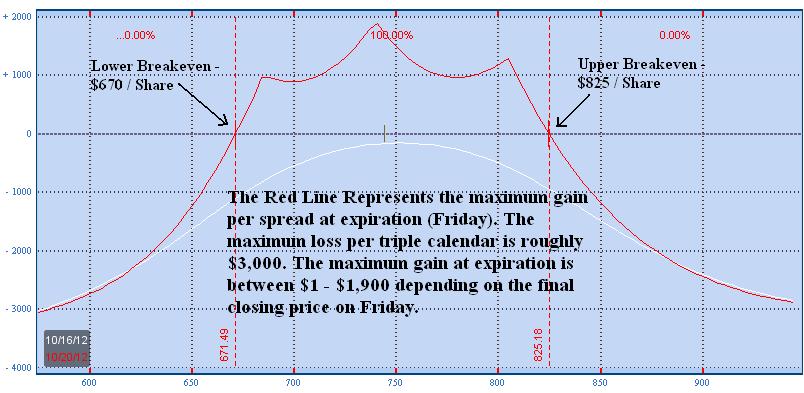

The GOOG Triple Calendar P&L curve is presented below:

This trade is short term and is designed to be closed on this coming Friday (10/19/12). Note that the break even points for the trade are around $670 and $840 respectively. These break even points are outside of a double of the expected move. Based on the current implied volatility driven probabilities, this trade has an approximate 90% chance of successfully producing a profit.

This is not the elusive “free money” trade either. Since we have discussed that trade for several weeks, I think the reader gets the idea there is no such thing. Option trading success comes from constructing high probability trades and executing these trades in sufficient numbers that the statistical law of large numbers delivers the predicted success rates.

A corollary of this is not to “bet the farm” on any one trade. While we typically choose high probability trades, there is no such thing as “free money” and a low probability event cannot be allowed to curtail your trading career.

Happy Trading!

JW Jones

Simple ONE Trade Per Week Trading Strategy? Join http://www.thetechnicaltraders.com/247-15.html today with our 14 Day Trial

This material should not be considered investment advice. J.W. Jones is not a registered investment advisor. Under no circumstances should any content from this article or the OptionsTradingSignals.com website be used or interpreted as a recommendation to buy or sell any type of security or commodity contract. This material is not a solicitation for a trading approach to financial markets. Any investment decisions must in all cases be made by the reader or by his or her registered investment advisor. This information is for educational purposes only.

[…] Control Risk With Options […]