By Elliott Wave International

While everyone searches for the Holy Grail of forecasting, which does not exist, there is one method of analysis that stands apart from the slew of momentum-based indicators, all of which by definition lag the market. The Elliott Wave Principle is based on the concept that crowd behavior is patterned and that these patterns are easily discerned in the prices of freely traded markets. This alone sets it apart in the world of technical analysis.

1. Identifies Dominant Trend in Any Timeframe

The Wave Principle identifies the direction of the dominant trend in any timeframe. A five-wave advance on a daily chart identifies the dominant trend as up on a daily basis. Looking at the same instrument on an hourly chart might reveal that the dominant trend on an hourly basis is down within the larger daily chart timeframe.

2. Identifies a Countertrend Move

The Wave Principle also identifies countertrend moves. The three-wave pattern is a corrective response to the preceding five-wave pattern. Knowing that a near-term move in price is merely a correction within a larger uptrend is valuable information.

3. Identifies the Maturity of a Trend

Elliott catalogued a finite number of patterns to which the markets adhere. Once a pattern is over, it’s over. For example, if prices are advancing in the fifth wave of a five-wave advance, and the fifth wave has already completed four of its subwaves, one more subwave is all that is required to complete the pattern, which, by definition, will lead to a change of trend.

4. Identifies Price Targets

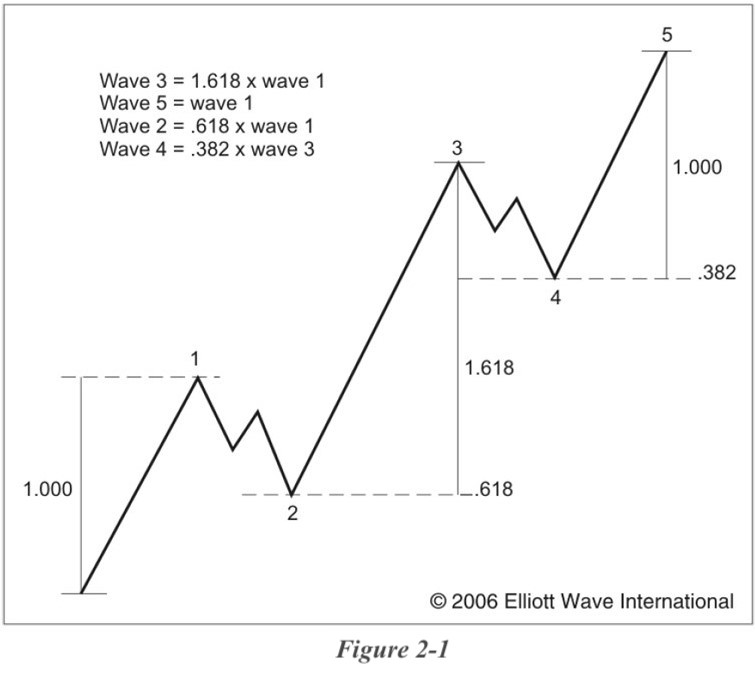

The Wave Principle also provides price targets based on common pattern relationships. When R.N. Elliott wrote about the Wave Principle in Nature’s Law, he stated that the Fibonacci sequence was the mathematical basis for the Wave Principle. Elliott waves, both impulsive and corrective, frequently adhere to Fibonacci proportions, as illustrated in Figure 2-1.

5. Identifies Context

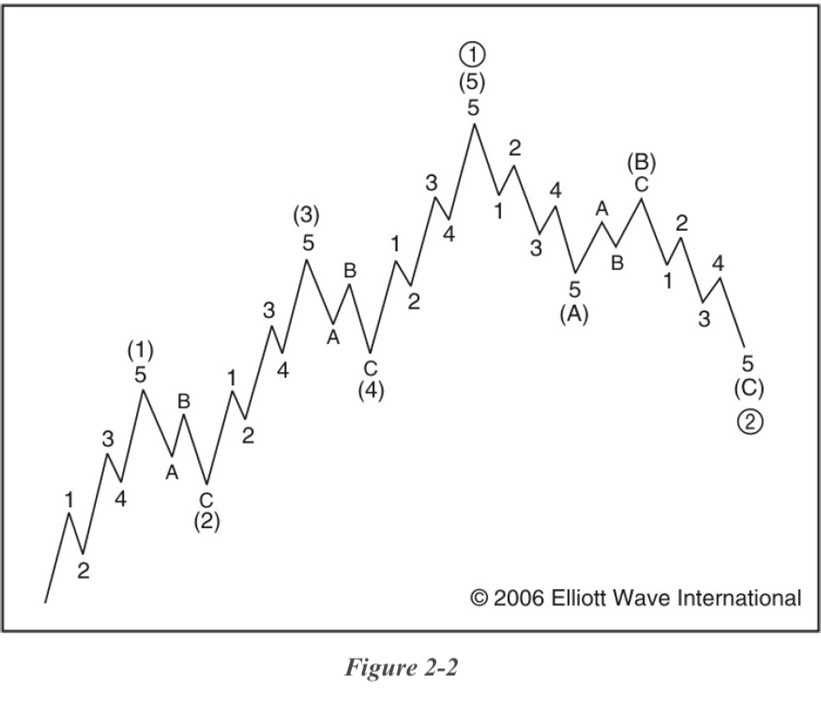

Perhaps most important, Elliott observed that wave patterns form larger and smaller versions of themselves. This repetition in form means that price activity is fractal, as illustrated in Figure 2-2. Wave (1) subdivides into five smaller waves yet is part of a larger five wave pattern. This process is occurring at every degree, all the time, and is the key to understanding what market probabilities are next.

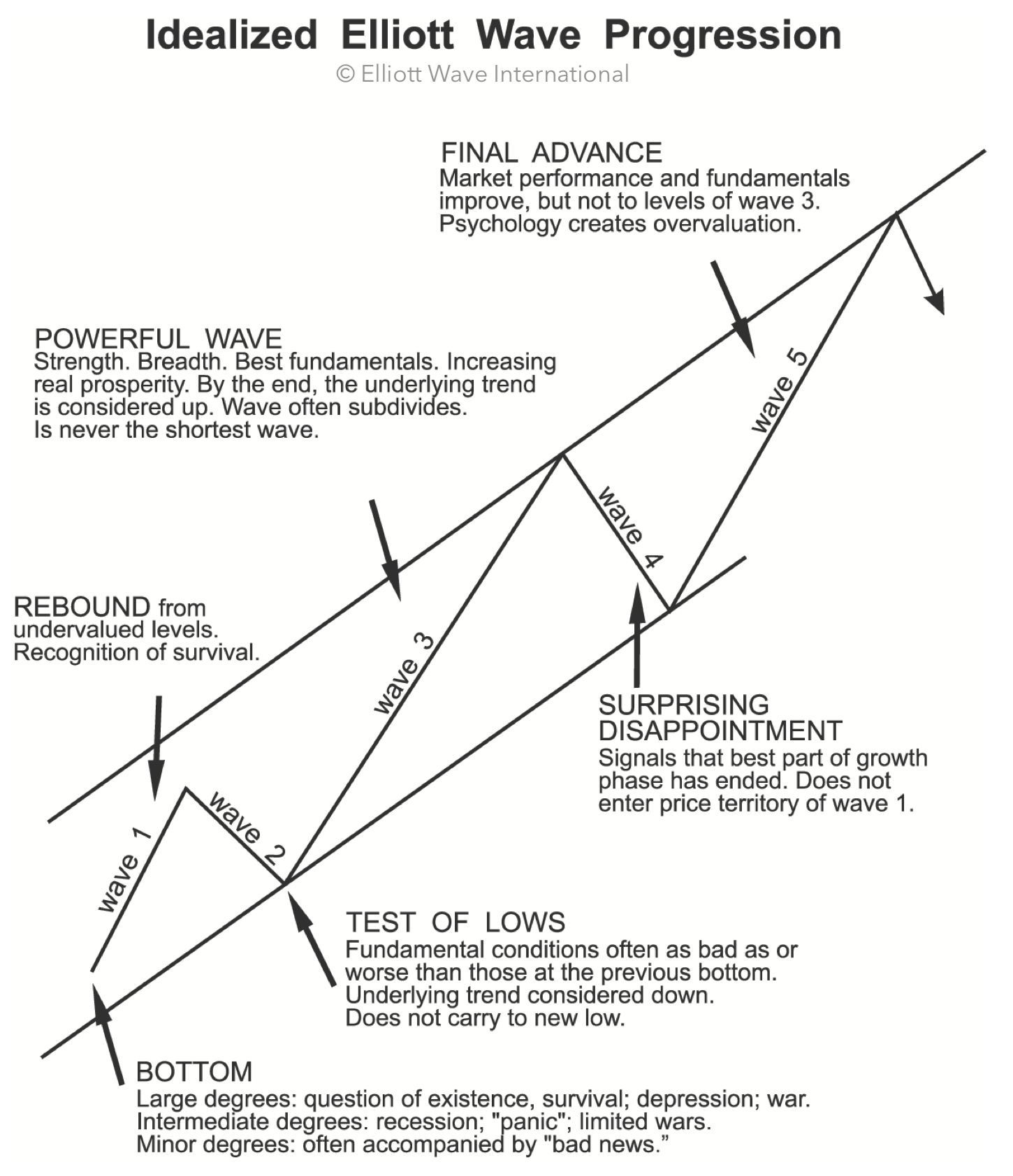

“The Wave Principle” is Ralph Nelson Elliott’s discovery that social, or crowd, behavior trends and reverses in recognizable patterns. Elliott isolated patterns of directional movement, called waves, that recur in markets. These waves reflect mass psychological states. The two charts below summarize some of their characteristics.

12 Days, 12 Gifts to Help You Apply Elliott Waves

December 1-12, Elliott Wave International is giving away one free gift per day for 12 days. Each gift is a premium resource that people pay good money for throughout the year, but they’re yours free during this special time of year.

Want to learn more about wave psychology? Or get insights into how to apply Elliott waves to the markets? EWI Chief Commodity Analyst Jim Martens dives deeper into wave psychology and more in his Basics video — your Day 1 gift.

But that’s just the start. There are 11 more helpful resources waiting for you inside the event.

Learn more and join 12 Days of Elliott Wave now

This article was syndicated by Elliott Wave International and was originally published under the headline Five Benefits of Using the Elliott Wave Principle to Make Decisions. EWI is the world’s largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

Speak Your Mind