It has long been said that the key to successful investing is to be greedy when others are fearful and fearful when others are greedy. This is excellent advice if you have the fortitude to actually do it. If you succeed you will get out of the market when even the bag-boys at the supermarket are talking about investing in stocks and you will get in when no one else is interested in even thinking about stocks. This has been Warren Buffet’s biggest skill. He buys when others are selling and sells when others are buying. In today’s article we take a slightly different look at the battle between greed (hope) and fear. Tim McMahon~editor

Investor Hope vs. Fear

Collective investor psychology: an insight from the long forgotten Mr. Gates

By Elliott Wave International

Can an investor ever know enough about financial markets to make a truly informed decision?

Even professionals must cope with imperfect knowledge, and the constant uncertainty that comes with it. That’s why every investor looks to others for signals about what to do.

Have you ever watched a dog interact with its owner? The dog repeatedly looks at the owner, taking cues constantly. The owner is the leader, and the dog is a pack animal alert for every cue of what the owner wants it to do.

Participants in the stock market are doing something similar. They constantly watch their fellows, alert for every clue of what they will do next. The difference is that there is no leader. The crowd is the perceived leader, but it comprises nothing but followers. When there is no leader to set the course, the herd cues only off itself, making the mood of the herd the only factor directing its actions.

The Elliott Wave Theorist, May 2009

Around the turn of the last century, Elmer Gates also observed how people take cues from others. He once ran the largest private non-commercial laboratory in the United States and obtained more invention patents than Thomas Edison. Remarkably, he worked on his inventions only during his spare time. His regular working hours were devoted to the study of the mind. Gates noted:

A companion, helper, associate, co-worker, influences one’s mental functioning by every gesture, tone, look, suggestion, opinion, approval or disapproval, argument, and mood. Minds interact consciously and subconsciously especially during quiescence, dirigation, introspection, and awareness; by their congeniality, presence and other ways.

Elmer Gates and the Art of Mind-Using (p. 246)

Investors take their cues from others then rationally justify their buy or sell decisions

Most market observers believe that investors respond logically to the latest news and buy or sell based on objective valuations.

Nothing could be further from the truth.

If investor behavior was rational, price charts would be linear and without sharp rises or declines. But that is not the case. The market’s price charts do show sharp price rises and steep declines, often when the market’s fundamentals offer no explanation to justify such a move. In a word, those near-vertical price moves are irrational. They’re not driven by logic, but by hope or fear.

People have no idea where prices are going, so to satisfy the reasoning portions of their brains, they make up reasons to justify their buying and selling actions….Investors are not reasoning but unconsciously herding, and unconscious processes aren’t random; they proceed according to mental constructs. That’s why financial markets display patterns such as persistent trends, head and shoulders formations, trend channels, Elliott waves, and so on. [emphasis added]

The Elliott Wave Theorist, January 2008

These price patterns occur at all degrees of trend. That means collective investor psychology is evident in 5-minute, hourly, daily, weekly, monthly, quarterly and yearly charts.

Investor hope is even on display during major market down-trends

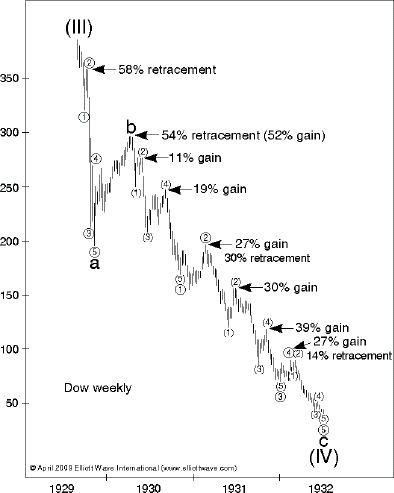

Notice how the Dow Industrials rebounded after the 1929 crash but before the worst part of the price decline of 1930-32 (see wave b in the chart below).

In the chart, you’ll notice that bursts of “hope” even occurred several times during the worst part of the decline itself. Memories of the Roaring ‘Twenties bull market still lingered.

More recently, investor hope lasted over three years after U.S. markets bottomed in March 2009.

Today’s market is a full degree of trend larger than even 1929-1932

After the market declined in May and the start of June, yet another burst of hope started on June 4. But brace yourself.

Get ready for a psychological change that will be reflected in the price patterns of U.S. markets

Learn to Think Independently

You’ll get some of the most groundbreaking and eye-opening reports ever published in Elliott Wave International’s 30-year history; you’ll also get new analysis, forecasts and commentary to help you think independently in today’s tumultuous market.

Download Your Free 50-Page Independent Investor eBook Now

This article was syndicated by Elliott Wave International and was originally published under the headline Witness the Epic Battle Between Investor Hope and Investor Fear. EWI is the world’s largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

Speak Your Mind