How about both?

By Elliott Wave International

You can’t go ten minutes on financial media these days without coming across a reference to inflation. That is, consumer price inflation to be more exact — the measurement of changes in the prices of consumer goods and services that the entire world has been hoodwinked by central banks into thinking is the definition of inflation. The proper definition of inflation is the expansion of money and credit in an economy. On that definition, most major economies have been experiencing high inflation for decades.

Sigh, nevertheless, the focus for the markets at this moment is on a potential rise in consumer price inflation. The general underlying narrative from conventional analysts is that this is a good thing for markets because it is preferable to consumer price deflation. But is it?

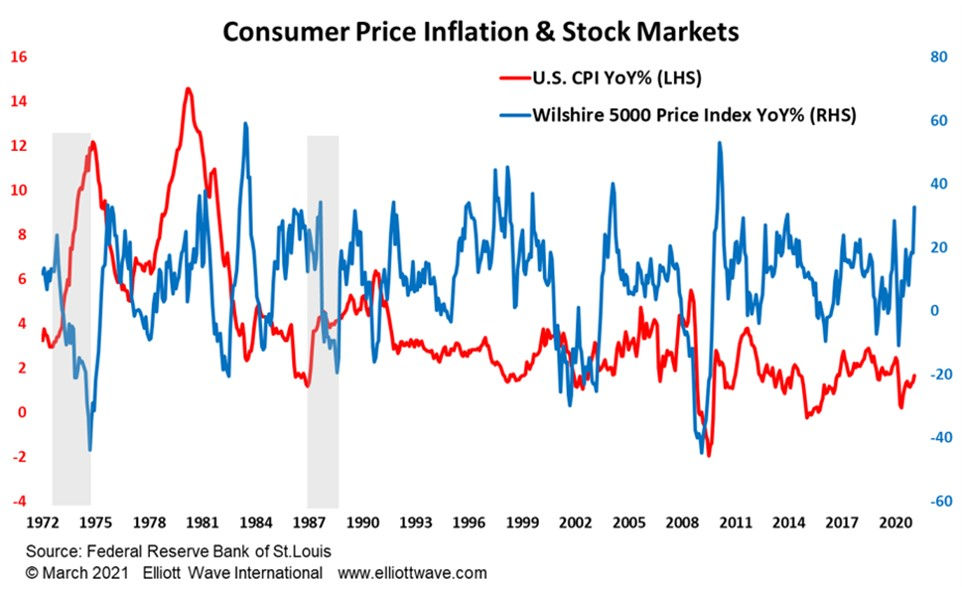

Looking at the U.S. as an example, the chart below shows the annual percentage change in the stock market versus the annual percentage change in consumer prices. We can see that when consumer price inflation is accelerating, it has often coincided with periods of stock market declines, not advances. This was especially the case in the “stagflation” of the early-to-mid 1970s as well as from 1987 to 1988 (encompassing the famous stock market crash).

The correlation coefficient between the two series since 1972 is actually negative, coming in at -0.13. In other words, there has been no discernible relationship between the two series and, whatever relationship does exist, has one going up when the other is going down. Interestingly, the correlation coefficient from 2008 and the onset of the Great Monetary Delusion (sorry, quantitative easing, or QE) comes in at a positive 0.22. Although that positive coefficient is in support of the “higher CPI is good” brigade (aka almost everyone), it is still way too low for any relationship to be said to exist from a statistical point of view.

In any case, there already HAS been high price inflation coinciding with the fastest rate of monetary inflation in history. That price inflation has been asset price inflation, with the U.S. stock market currently clipping along at a 32% annual rate!

In conclusion, therefore, we should not automatically expect higher levels of consumer price inflation to coincide with a healthy stock market (and therefore economy). In fact, historical evidence suggests that it might be worse for the markets than consumer price deflation.

Are you prepared for a deflationary depression?

If you’re uncertain about the answer, Elliott Wave International’s special free report, “What You Need to Know About Protecting Yourself from Deflation,” can give you some one-of-a-kind ideas. Today.

It’s a $99 value, free for a limited time.

Read it instantly: “What You Need to Know About Protecting Yourself from Deflation.”

This article was syndicated by Elliott Wave International and was originally published under the headline Should Stock Markets Fear Inflation or Deflation?. EWI is the world’s largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

Speak Your Mind