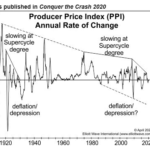

You can’t go ten minutes on financial media these days without coming across a reference to inflation. That is, consumer price inflation to be more exact — the measurement of changes in the prices of consumer goods and services that the entire world has been hoodwinked by central banks into thinking is the definition of inflation. The proper definition of inflation is the expansion of money and credit in an economy. On that definition, most major economies have been experiencing high inflation for decades.

Deflationary Psychology Versus the Fed: Here’s the Likely Winner

Most economists believe the Fed can prevent financial crises and depressions. [EWI’s analysts] disagree. Socionomic theory proposes that naturally fluctuating waves of social mood regulate financial optimism and the economy. They are unconscious and cannot be managed.

Deflation: The Trend That’s Become Too Obvious To Ignore

As the biggest credit bubble in history continues to shrink, consumer prices have stayed flat over the past several months, meaning there is no sign of inflation to come, despite growing commitments from the U.S. government. So what’s keeping inflation at bay, given all the stimulus money promised? The answer: Deflation — an overwhelming urge […]

20 Questions with Robert Prechter: Long Decline Ahead

The following article is an excerpt from Elliott Wave International’s free report, 20 Questions With Deflationist Robert Prechter. It has been adapted from Prechter’s June 19 appearance on Jim Puplava’s Financial Sense Newshour. Jim Puplava: I want to come back to government spending, but first I want to move onto the stock market. In your […]

20 Questions with Robert Prechter: Signs Point to Deflation

The following article is an excerpt from Elliott Wave International’s free report, 20 Questions With Deflationist Robert Prechter. It has been adapted from Prechter’s June 19 appearance on Jim Puplava’s Financial Sense Newshour. To read the entire conversation, access the 20-page report here. Jim Puplava: Bob, I want to pick up from last September. Since […]

Deflation: How To Survive It

The M3 money supply in the U.S. is contracting fast, and deflation is suddenly in the news again. It’s a good moment to catch up on a few definitions, as well as strategies on how to beat this rare economic condition. And who better to ask than EWI’s president Robert Prechter? Here’s a free excerpt from a collection of his most important essays on deflation.

Signs of Deflation You Might Not be Able to See Clearly

Most people assume that they are investing in an inflationary world, because that’s what the Fed tells them it’s worried about. But deflationary forces continue to loom even though they are not so visible. Here are five that you might not be able to see clearly.

Bob Prechter Points Out The Many Signs Of Deflation

Everywhere you look, the mainstream financial experts are pinning on their ‘WIN 2’ buttons in a show of solidarity against what they see as the number one threat to the U.S. economy: Whip Inflation Now. There’s just one problem: They’re primed to fight the wrong enemy. In a special report, Bob Prechter uncovered the ‘Continuing and Looming Deflationary Forces’ underway right now.

Market Myths Exposed: Inflation Is Not A Threat, Deflation Is

Most people are confident they can recognize a myth when they hear one: Wearing a hat causes baldness; eating a bunch of carrots gives you perfect vision; ‘light’ cigarettes are better for your health than the regular kind. But what about this sentence: Inflation is the number one threat to the US economy? Myth? You betcha.

Understanding the Fed — Not Just the Myths About the Fed

If you would like to understand more about how the U.S. Federal Reserve works, you can spend time on its website — or you can get the real story. Elliott Wave International has collected eight of Robert Prechter’s most trenchant articles about what the Fed actually does. He takes on the misleading myths about the Fed and explains what’s really going on as he writes about these topics