Most stock market investors get fooled at major price turns. Why? Because a bottom never feels like a bottom and a top never feels like a top – how many bears could you count in 2007, right before stocks tanked and the Great Recession followed? This idea was embodied by the quote attributed to Barron Rothschild, an 18th-century member of the Rothschild banking family. He said that “the time to buy is when there’s blood running in the streets.”

The Fear of Missing Out

The fear of missing out (FOMO) is a powerful narcotic that often affects market participants near the top of a cycle. And before long, you hear the “bag-boy” at the supermarket bragging about his “portfolio”. When that happens it is time to follow Warren Buffet’s sage advice and “Be fearful when everyone else is greedy and greedy when everyone else is fearful.”

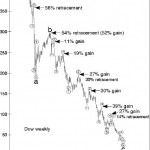

The Investor’s Battle Between Hope and Fear

Editor’s Note: It has long been said that the key to successful investing is to be greedy when others are fearful and fearful when others are greedy. This is excellent advice if you have the fortitude to actually do it. If you succeed you will get out of the market when even the bag-boys at the supermarket […]