“Supply and demand” Doesn’t Always Determine the Price Trend of Crude Oil

By Elliott Wave International

As you probably know, Hurricane Ida hit Louisiana on August 29, the exact date that Hurricane Katrina made a Louisiana landfall sixteen years earlier.

On August 30, the Wall Street Journal said:

Oil Industry Surveys Damage After Hurricane Ida Slams Louisiana

The storm disrupted fuel supplies, and the speed of the recovery will depend on how long it takes for refineries to come online amid flooding and power outages

Did oil prices skyrocket due to the disruption in oil production? Well, Bloomberg reported (August 30) that prices initially fell 1.6% [as Ida made landfall] before they “edged” higher.

So, no, oil prices did not “skyrocket.” As of this writing on August 31, crude oil’s price is roughly in the same neighborhood as it was before Hurricane Ida hit.

This is mentioned because many energy market observers might think that a supply disruption would “cause” oil prices to zoom higher. However, contrary to conventional belief, the trend of oil prices is not always determined by “supply and demand.”

Indeed, the oil production disruption associated with Hurricane Katrina was far worse than what occurred with Ida.

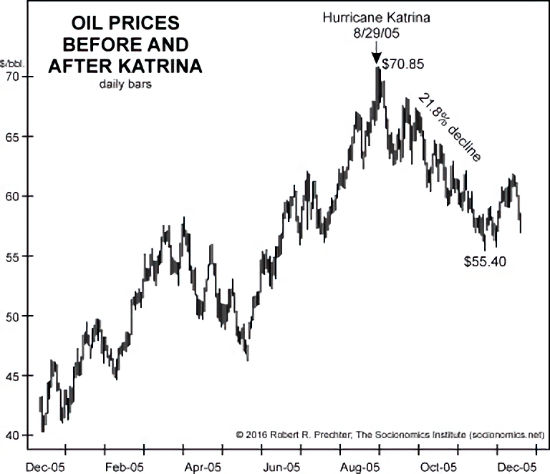

Even so, take a look at this classic chart from a past Elliott Wave Theorist, a monthly publication that analyzes financial markets and social trends. The associated commentary is below the chart:

The chart shows the day [Hurricane Katrina made landfall]: August 29, 2005, right at a top and just before a three-month oil-price slide of over 20%. A record-breaking … disruption in the supply of oil failed to make oil prices zoom. On the chart, it even looks as if somehow the event made prices fall.

That doesn’t necessarily mean that the price of oil will take the exact same path following Hurricane Ida.

The point is: Financial markets like commodities are not always subject to the economic law of supply and demand but instead are endogenously regulated and governed by the Wave Principle.

So, what happens with oil’s price path now hinges on the current Elliott wave structure of oil’s price chart.

If you’d like to learn about how the Elliott wave model can help you analyze financial markets, you are encouraged to read the Wall Street classic Elliott Wave Principle: Key to Market Behavior by Frost & Prechter.

Here’s a quote from the book:

Although it is the best forecasting tool in existence, the Wave Principle is not primarily a forecasting tool; it is a detailed description of how markets behave. Nevertheless, that description does impart an immense amount of knowledge about the market’s position within the behavioral continuum and, therefore, about its probable ensuing path. The primary value of the Wave Principle is that it provides a context for market analysis. This context provides both a basis for disciplined thinking and a perspective on the market’s general position and outlook. At times, its accuracy in identifying and even anticipating changes in direction is almost unbelievable.

The Wave Principle can be used to analyze any widely traded financial market, like crude oil, stocks, gold, bonds, currencies, and more.

Here’s the good news: You can read the online version of Elliott Wave Principle: Key to Market Behavior for free once you become a Club EWI member.

Club EWI is the world’s largest Elliott wave educational community and is free to join. You are under no obligations as a Club EWI member. At the same time, you’ll enjoy access to a wealth of Elliott wave resources on investing and trading.

Get started by following this link: Elliott Wave Principle: Key to Market Behavior — free and unlimited access.

You might also like:

- Annual average Crude Oil Prices in Table form

- Monthly Average Crude Oil Prices

- Historical Oil Prices Chart

- Oil vs. Gold- Why Compare Commodity Prices Against Each Other?

- Oil, Petrodollars and Gold

- Hurricane Katrina: The Economics of Disaster

- Inflation Falls by Half – As Hurricane Katrina Effects Wear Off

Speak Your Mind