When we look at the recent volatility of the market it is easy to become depressed, confused or just plain frustrated (or perhaps even a little of each). Even the legendary investor Warren Buffet says the market is like a “Drunken Psycho”, so what are mere mortals like ourselves to do? In today’s post we get a little peek into how to beat the market. ~Tim McMahon, editor.

How to Tame the Volatile Financial Markets

By Elliott Wave International

Up, down, up, down; 200 points higher, 300 points lower; rinse and repeat!

It isn’t easy being an investor in the U.S stock market these days. Honestly, it feels more like being in a clinical trial for mood stabilizers. Or, as the market oracle himself Warren Buffett described it in December 2014:

“Mr. Market is kind of a drunken psycho. Some days he gets very enthused. Some days he gets very depressed. And when he gets really enthused… you sell to him, and if he gets depressed, you buy from him. There’s no moral taint attached to that.”

Moral taint, no. But, there is a pretty significant learning curve attached tothat. To wit: You have to know in quantitative terms what “really enthused” or “depressed” looks like on a price chart — before the mood swing. As in tangible, objective criteria that signals

- How high is too high?

- How low is indicative of a bottom?

- At what exact price level is the immediate trend confirmed — or canceled out?

Now, if you can answer all three questions, then we’re actually getting somewhere. If you have these answers, your chances of taming the drunken psycho — rather than be tormented by it — are greatly increased.

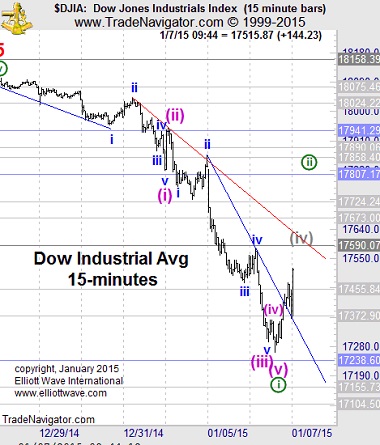

Enter Elliott wave analysis and the last two, tumultuous weeks in the Dow Jones Industrial Average. Let’s take it from the top, at the Dow’s December 26 high of 18,103.

That morning, Elliott Wave International’s Intraday Stocks Specialty Service identified a five-wave move to the upside. A finished five-wave move indicates a complete Elliott structure, and so the case was made for a top:

“Wave v (circled) up has extended but can be counted as ending. With the series of higher lows and higher highs, we’ll need to see a break of the pattern to make a good case for a top. Tuesday’s late low at 18028 will have to give way to argue that a sizable decline has begun. ”

In the days following, the Dow endured a broad sell-off. On January 6, EWI’s Intraday Stocks Pro Service identified a likely target for prices to catch their breath:

“Staying under the 17,372 keeps the pressure down and pointed at 17,238.”

On January 7, the Dow bottomed just above its 17,238 target and Intraday Stocks Pro Service prepared the stage for two immediately bullish scenarios — the latter pointing prices all the way to above 17,807:

“No trade should occur appreciably beyond 17,590 if the grey wave (iv) potential is to be realized. Beyond 17,590 would be much more clearly circled wave ii in progress, which could be hunting for Monday’s gap just above 17,807. Make the Dow commit to one of these counts before getting involved.”

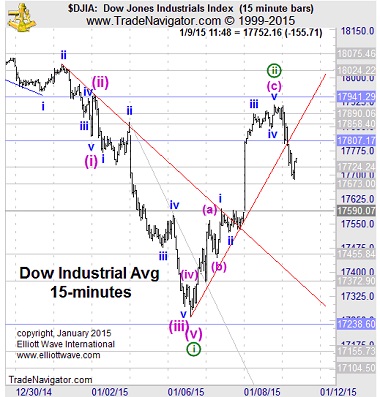

From there, the Dow took to the upside, quickly knocking out its lesser-bullish wave (iv) count and sealing the way for higher highs:

January 8 Intraday Stocks Specialty Service: “Nearly up to the 17,807 subdivide cited yesterday as the probable minimum for circled wave ii action. Yet the Dow is likely not finished.”

Not finished indeed. The Dow continued to advance to close at 17,908. The next day (Jan. 9), the market reversed:

This is a great example of Elliott wave analysis in action — but let’s be honest here. There’s no quick fix strategy for taming the drunken psycho of financial markets. If “buying high and selling low” was simple, we’d all be Warren Buffetts. But Elliott wave analysis does give you an objective method for identifying high-probability trade set-ups, and minimizing your potential for loss along the way.

The key to using Elliott analysis in the markets is to:

- Identify the trend

- Identify the counter-trend

- Determine the maturity of a trend

- Determine Price Targets

- Determine specific points of ruin

If you are just starting with Elliott wave analysis doing these 5 things on your own can be difficult. To help you get started you can get a free report, entitled “How the Wave Principle Can Improve Your Trading” which goes down the list and shows you how to use these five invaluable advantages.

Plus, the 6-page, chart-filled report also includes a bonus lesson on how to calculate protective stops.

The entire report is 100% free to Club EWI members -and best of all – Club Membership is free as well.

Click Here to Join 325,000 other members and get instant access to this report, considered required reading by all real Elliott enthusiasts!

Speak Your Mind