Traditional wisdom suggests a quick and easy “Balanced Portfolio” of 60% stocks and 40% bonds. But there are pitfalls to this type of quick and dirty balancing. Theoretically, when stocks fall, bonds should rise or at least maintain their value. More advanced balancing systems might add a Gold or precious metals component of perhaps 10%. Still, further refinement can decrease the stock portion and increase the bond portion as you get closer to retirement age. On average, a 20-year-old has a lot longer to recover from a market downturn than an 80-year-old. So, a younger person can accept higher risk in return for a higher reward, so a 20-year-old might have 80% in stocks and 20% in bonds. An 80-year-old, on the other hand, might have 80% in Bonds and 20% in stocks. In the following article, the Editors at Elliott Wave International look at some of the pitfalls of the balanced portfolio approach. ~ Tim McMahon, editor

So Much for the Conventional Wisdom of the “Balanced Portfolio”

By Elliott Wave International

In his February 2022 book, Last Chance to Conquer the Crash, Robert Prechter said:

Countless advisors have counseled “diversification,” a “balanced portfolio,” and other end-all solutions to the problem of allocating your investments. These approaches are delusional. … No investment strategy will provide stability forever.

That certainly has applied to the classic 60% stocks / 40% bonds portfolio this year.

On Oct. 14, a Reuters headline said:

’60/40′ Portfolios Are Facing Worst Returns in 100 Years: BofA

Of course, everyone knows that stocks are risky, but many investors expect bonds to provide a cushion in case equities slide into a downtrend. And, indeed, the stock market has been trending lower since January.

But bond prices have taken a hit, too. A BIG one. As you probably know, bond prices decline when yields rise, and that’s what’s taken place.

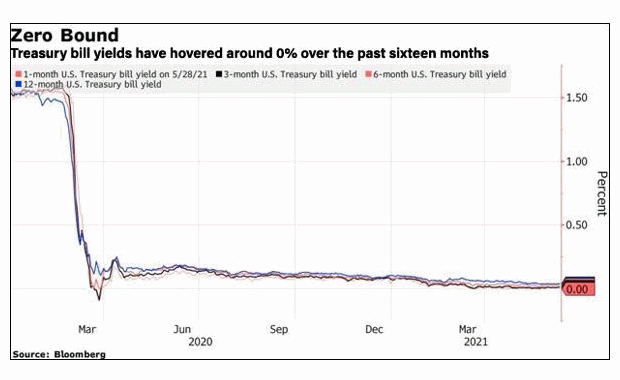

You may find it hard to believe, but Elliott wave patterns and sentiment readings in the bond markets warned of this. For example, the July 2021 Elliott Wave Theorist, a monthly publication (since 1979) that analyzes financial markets and major cultural trends, showed this chart and said:

U.S. Treasury bill rates have edged closer and closer to zero for over a year. The complacency about the nonexistent T-bill yield in the face of unprecedented inflating by the government and the Fed is truly amazing. … The Fed’s cavalier inflating is borne of optimism. … When optimism and complacency finally melt like popsicles in the sun, the lines in [the chart] will turn up.

Federal Reserve Officials Project Rate Increases in 2023 [emphasis added]

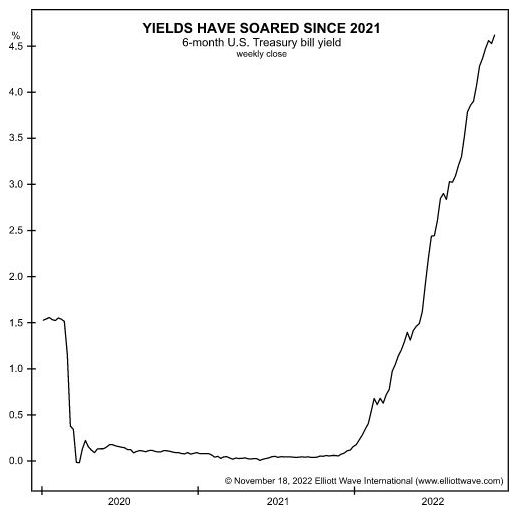

This next chart of the 6-month U.S. Treasury bill yield, which published in the Nov. 18, 2022 Elliott Wave Theorist, shows what we all know: Rates began to turn up more than a year before 2023 and then soared higher.

The question now is: What’s next?

Elliott wave analysis answered this question before, and it can help you answer it now.

You can read more about what Elliott Wave Theorist editor, and EWI Founder, Robert Prechter expects next in the Special Report: Preparing for Difficult Times. The report is free — for a limited time — inside their “12 Days of Elliott” event. You need only join Club EWI to read it, along with 11 other fascinating resources, December 1-12.

You can join Club EWI without any cost or obligation. All the while, you’ll enjoy complimentary access to an abundance of Elliott wave resources on financial markets and investing.

Get started by following the link: 12 Days of Elliott — get free and instant access.

This article was syndicated by Elliott Wave International and was originally published under the headline 60% stocks, 40% bonds? Ha!. EWI is the world’s largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

Tim, given your experience, is there a reputable site that uses EW etc to provide trend buy/sell signals for long term investing? I realize these trend signals are not perfect so I’m not looking to depend on them, but I’m looking for reinforcement to what I’m seeing in long trends.

Please can you email me.

Keith

Keith,

The premiere site for Elliott Wave information is Elliott Wave International. You can get a Free Pass to check out their stuff here.