With the FED tightening and raising rates, member banks are feeling the pinch and are being forced to adjust their lending practices.

The COVID panic of 2020 and 2021 pushed mortgage rates to record lows below 3%. But with the FED’s money pumping during the same period, inflation soared to over 8%.

Initially, the FED felt the inflation surge was “transitory” and was the result of supply shortages due to limited production during the pandemic. So, they refused to change their easy money stance. However, as inflation continued to surge, the FED eventually decided that it had to act.

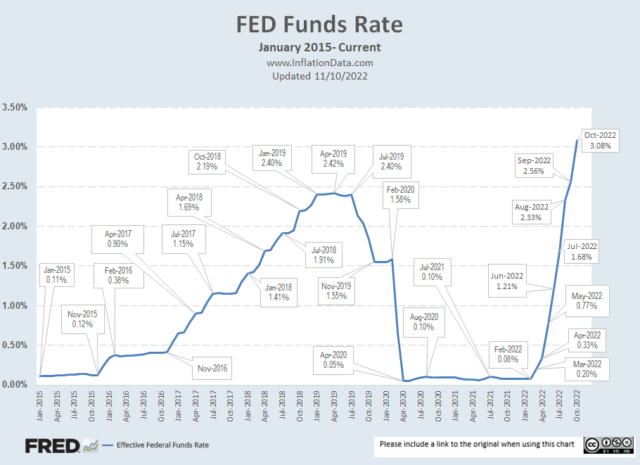

So the FED began tightening (i.e., reducing FED assets), and raising FED funds rates. As we can see in the chart below, the FED funds rate was virtually zero at the beginning of 2022, and by October, it had shot up to 3.08%.

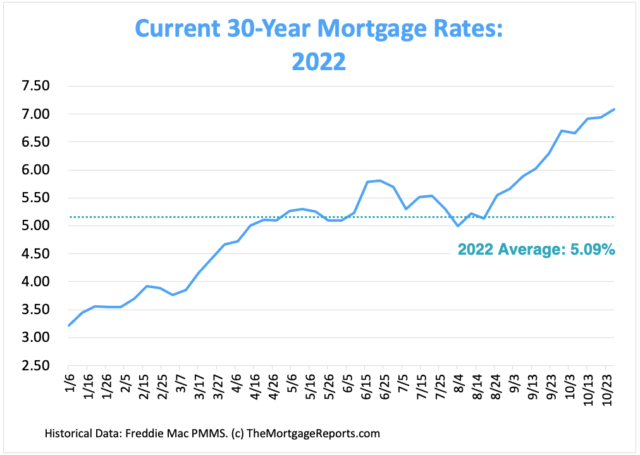

Consequently, banks have raised their 30-year mortgage rates as well. In the following chart by The Mortgage Reports we can see the 30-year mortgage rate started 2022 at around 3.25% and climbed to over 7% by the end of October.

So, at the beginning of 2022, 30-year mortgage rates were 3.17% higher than the FED funds rate (i.e. 3.25-0.08=3.17%), and currently, they are just over 4% higher than the FED funds rate indicating an increasing reluctance to loan or at least a necessity to be better compensated for long term loans.

So, at the beginning of 2022, 30-year mortgage rates were 3.17% higher than the FED funds rate (i.e. 3.25-0.08=3.17%), and currently, they are just over 4% higher than the FED funds rate indicating an increasing reluctance to loan or at least a necessity to be better compensated for long term loans.

In the following article by Elliott Wave International editors, they look at some of the implications of this increase in rates. ~Tim McMahon, editor

Banks Are Becoming More Cautious About Lending

And the implications are bigger than just getting a loan

By Elliott Wave International

Robert Prechter’s Last Chance to Conquer the Crash discusses the psychological aspect of a deflation:

When the trend of social mood changes from optimism to pessimism, creditors, debtors, investors, producers, and consumers all change their primary orientation from expansion to conservation. As creditors become more conservative, they slow their lending.

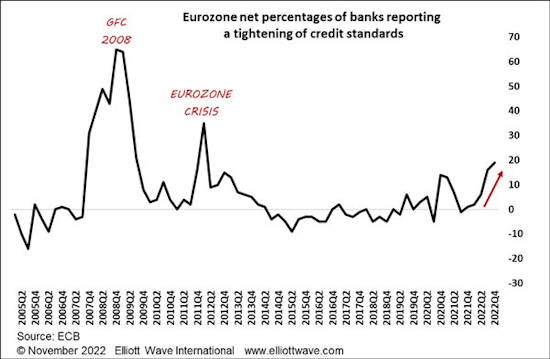

Evidence of that developing financially conservative mindset is seen in this chart from the just-published November Global Market Perspective, a monthly Elliott Wave International publication that covers 50-plus worldwide financial markets (commentary below):

Eurozone stock market indices have declined this year indicating that the trend in social mood is negative. This trend towards ever more caution can be seen in the chart, from the latest Euro Area Bank Lending Survey released by the European Central Bank. It shows that a net 19% of banks are tightening credit standards, up from a neutral zero at the end of last year, meaning that banks are becoming more cautious about lending.

Just know that there’s room for many more banks to tighten credit standards.

What does a rising trend in tightening credit standards mean? Let’s return to the November Global Market Perspective:

As credit conditions become ever tighter, expect defaults to rise and debt to deflate.

And, speaking of defaults, here are some recent news items:

- Private lender cuts Canada mortgage business as defaults rise (The Business Times, Oct. 30)

- Ally Financial Inc. … saw charge-offs for retail auto loans quadruple in the third quarter. (Bloomberg, Oct. 21)

- Leveraged Loan Default Volume In The U.S. Has Tripled This Year (Forbes, Oct. 2)

As social mood continues to grow more negative, expect more defaults in various sectors around the world.

Know that the price trend of the stock market directly reflects social mood, and Elliott Wave International’s way of keeping on top of the stock market’s trend is by employing the Elliott wave model.

If you’d like to learn about Elliott wave analysis, the definitive text on the subject is Frost & Prechter’s Elliott Wave Principle: Key to Market Behavior. Here’s a quote from the book:

The Wave Principle is governed by man’s social nature, and since he has such a nature, its expression generates forms. As the forms are repetitive, they have predictive value.

Sometimes the market appears to reflect outside conditions and events, but at other times it is entirely detached from what most people assume are causal conditions. The reason is that the market has a law of its own. It is not propelled by the external causality to which one becomes accustomed in the everyday experiences of life. The path of prices is not a product of news. Nor is the market the cyclically rhythmic machine that some declare it to be. Its movement reflects a repetition of forms that is independent both of presumed causal events and of periodicity.

The market’s progression unfolds in waves. Waves are patterns of directional movement.

If you’d like to access the online version of this Wall Street classic, you may do so for free once you become a member of Club EWI, the world’s largest Elliott wave educational community.

You can join Club EWI for free, and do know that members enjoy complimentary access to an abundance of Elliott wave resources on investing and trading.

Get started by following this link: Elliott Wave Principle: Key to Market Behavior — get free and instant access.

This article was syndicated by Elliott Wave International and was originally published under the headline “Banks are becoming more cautious about lending”. EWI is the world’s largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

Speak Your Mind