the FED’s raising interest rates has resulted in an “inverted yield curve” (i.e. short rates are higher than long interest rates) which puts extreme stress on banks and has resulted in some recent bank failures. In this article, the editors of Elliott Wave International look at the banking situation. ~Tim McMahon, editor

Are You Prepared for Widespread Bank Failures?

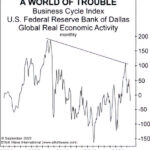

“This time, the world economy appears to be on much shakier footing”. The ideal time to prepare for almost anything in life, especially a potential circumstance that’s adverse, is before it happens. The problem is: Many people don’t know what will happen in their lives ahead of time.

However, sometimes warnings are provided yet they’re ignored or not taken seriously. A current warning from Elliott Wave International which people are urged to take very seriously is that the economic slowdown could morph into something far worse than a garden-variety recession.

Stress Test: How to Find the Safest Banks in the U.S. and Abroad

Banks of all sizes are riskier than they used to be (think about portfolios stuffed with derivatives, emerging market debt and non-performing commercial loans), so it makes good sense to have your own personal stress test to find out which you can trust. This special report gives you what you need to know — plus a list of the Top 100 Safest Banks in the U.S.

How Safe Is Your Bank, Really?

So far in 2010, the number of US bank failures has reached 25, a rate of two per week. This compares to 25 total bank failures for ALL of 2008, and three for 2007. Yet — no matter how grave the data gets, few people imagine the corporate banking crisis trickling down to average Joe or Jane and their lollipop-dispensing drive-through bank tellers.

Europe’s Return to Risky Investment

Over 100 banks are opening soon, buying junk bonds is gaining popularity and emerging markets are the trendy investment. Sound familiar? Europe appears to be returning to some bad investment habits.