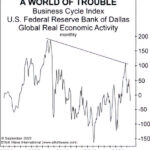

“This time, the world economy appears to be on much shakier footing”. The ideal time to prepare for almost anything in life, especially a potential circumstance that’s adverse, is before it happens. The problem is: Many people don’t know what will happen in their lives ahead of time.

However, sometimes warnings are provided yet they’re ignored or not taken seriously. A current warning from Elliott Wave International which people are urged to take very seriously is that the economic slowdown could morph into something far worse than a garden-variety recession.

Are You Prepared for Widespread Bank Failures?

Surging Housing Prices Are Entering The Stratosphere- Look Out Below

In my Inflation-Adjusted Housing index article, I included a chart that showed recent housing prices skyrocketing not only in nominal terms but in inflation-adjusted terms as well. This means that from a historical perspective houses are more expensive than at any time since 1900! In today’s article, Elliott Wave International editors tell us why we should expect housing prices to decline.

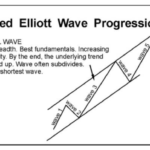

Is the Correction Over?

After a fairly rapid correction in January 2022, the market has started to rebound. So does that mean it’s safe to jump back into the market? After all, we saw a worse crash in January 2020 followed by a rapid rebound to new highs. And even the 2018 correction was short-lived. So have market participants become accustomed to quick rebounds? Or is this just a brief counter-trend rally?

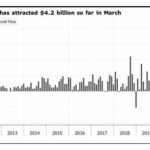

Crude Oil’s 2020 Crash: See What Helped (Some) Traders Pivot Just in Time

Since the start of 2020, crude oil has gone from “black gold” to “black days,” plummeting 70% for its “worst quarter on record”. As of March 30, oil prices circled the drain of a two-DECADE low near $20 per barrel. Is there any way an oil trader or active oil investor could look at the market’s crash and NOT see what one March 12 CNN article coined “a nightmare scenario”?

Stocks: Is the Worst Over or is there Worse Yet to Come?

Chris Ciovacco of Ciovacco Capital Management always presents a well-reasoned approach to the market in his “short-takes” video. He emphasizes that we need to look at the preponderance of the evidence but even that doesn’t “guarantee” any future market action. All that we can do is see what has happened in the past and determine the probability that it will happen that way again. Even if 90% of the time some indicator resulted in a rise (or fall) in the market one time out of ten the opposite could still happen so we need to be prepared and listen to what the market is telling us. In Yesterday’s video Chris Ciovacco looked at volatility (i.e. the VIX) and what it is telling us regarding the current state of the market. Interestingly, recent VIX activity was actually worse than in any other crash tracked since 1990 putting it on par with the 2008 crash and in terms of volatility it was actually worse than 2008.

Is the Buying Opportunity Here Yet?

With the market down so sharply many are speculating that it will rebound just as sharply but market sentiment might be indicating something else altogether.