Positive Message For Manufacturing

Stock prices have a high correlation to economic activity and earnings. History tells us bear markets are often kicked-off by recessions. The head of one of the nation’s closely watched manufacturing indexes says a recession does not appear to be imminent. From ThomasNet News:

In a one-on-one interview with ThomasNet News at the recent International Supply Management Conference in Las Vegas, Bradley Holcomb, chair of the Institute for Supply Management (ISM) Manufacturing Business Survey Committee, said the U.S. manufacturing sector will see revenue and production output increases and be aided by moderate supply price growth and fewer economic and political headwinds. “The message is positive for the rest of this year,” said Holcomb, based on his analysis of the latest quarterly survey of 350 purchasing and supply executives at medium and large manufacturing companies across the country who report business conditions to ISM. “The weather had some short-term impact, but it’s mostly behind us,” Holcomb added. “There are rising levels of confidence among consumers and CFOs, and this confidence is real. There is pent-up demand in the housing market, and our forecast shows contained, nominal price increases for the foreseeable future.”

Dow Theorists Become More Optimistic

On April 4, we discussed a concerning signal for stock investors and the economy based on Dow Theory. The signal has changed and this article covers the improvement in the observable evidence. Before we cover the updated charts, it is important to revisit the fundamental concepts they convey. Dow Theory is based on a series of Wall Street Journal articles written by Charles Dow. The basic tenets are easy to understand. Charles Dow believed that:

On April 4, we discussed a concerning signal for stock investors and the economy based on Dow Theory. The signal has changed and this article covers the improvement in the observable evidence. Before we cover the updated charts, it is important to revisit the fundamental concepts they convey. Dow Theory is based on a series of Wall Street Journal articles written by Charles Dow. The basic tenets are easy to understand. Charles Dow believed that:

- In order for industrial companies to increase their earnings, they had to produce and sell more goods.

- If industrial companies are selling more goods, then transportation companies must be delivering more goods to retailers and wholesalers.

- Therefore, in a healthy economy, both industrial companies and transportation companies should be experiencing revenue growth.

- If industrial and transportation companies are growing their revenues, then the industrial and transportation stocks should be attractive to investors.

- If industrial and transportation companies are doing well and are attractive to investors, both the Dow Jones Industrial Average and the Dow Jones Transportation Average should be making new highs in unison, serving to confirm a healthy economy.

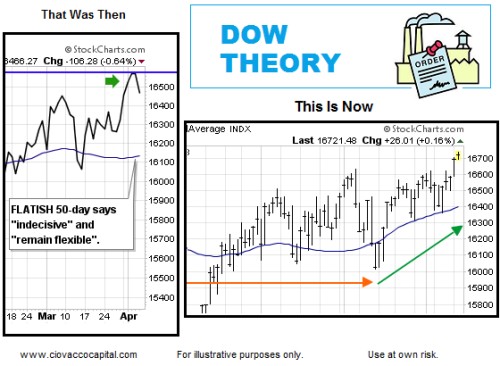

Signal: That Was Then

In April we described the concerns rooted in Mr. Dow’s theory as follows:

If investors believe industrial and transportation stocks are healthy and thus, attractive investments, that speaks to demand. When demand is strong, stock prices rise. Friday, the Dow Jones Industrial Average (DJIA) once again was unable to post a new closing high, leaving an economic divergence in place relative to the high made in the Dow Jones Transportation Average (DJTA) on April 1, 2014. The 50-day moving average, shown in blue below, helps us monitor the intermediate-term trend in the Dow Jones Industrial Average. The flat look of the Dow’s 50-day is indicative of economic indecisiveness on the part of investors. The inability of the Dow to post a new closing high is an economic yellow flag according to Dow Theory (see point 5 in the list above).

Signal: This Is Now

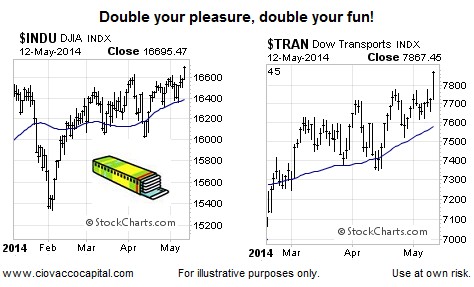

In Monday’s session both the Dow Jones Industrial Average and the Dow Jones Transportation Average made new highs. Therefore, the concerning economic non-confirmation has been taken off the table.

How Can This Help Us?

Everything we do revolves around probabilities and an uncertain future. The new highs in the Dow and Trannies tell us investor confidence in earnings, economic activity, and Fed policy is better than it was a few weeks ago when the Dow was unable to sustain a new high. Sustainability is still important. If the new highs are followed by weakness and a retreat below 16,580 on the Dow, it brings us back into a lower investor conviction realm. The longer the Dow stays above 16,580 the better for the bulls from an “odds of good things happening” perspective. In the more concerning April 4 article, we noted the flatish slope of the Dow’s 50-day was symptomatic of investors questioning the value of owning stocks (see left side below). Since then, the look of the 50-day moving average has improved, which aligns with improving probabilities of investment success (see right side below).

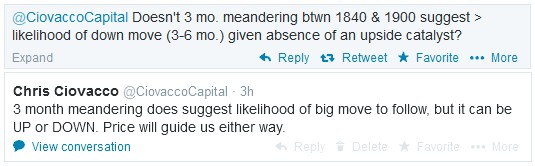

Investment Implications – Consolidation Is Not Biased

Like the Dow, the S&P 500 has been moving in an indecisive manner in recent months. The Twitter Q & A below regarding the S&P’s sideways movement has been common in recent weeks.

Charts Align With Bullish ISM Outlook

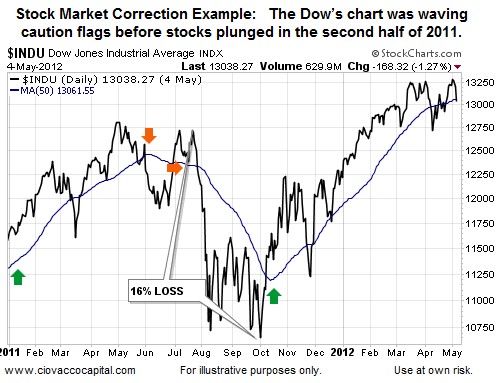

What do we mean by price (or the market) will guide us? In the April 4 article, we presented the chart below as an example of how the slope of the Dow’s 50-day moving average provides input regarding investor tolerance for risk.

Therefore, if we see the slope of the Dow’s 50-day roll over in 2014, similar to the period marked by the orange arrows above, then the “observable evidence” will be giving us “pay closer attention to risk management” signals. The most recent signals from Dow Theory and the 50-day have been leaning more toward the bullish stock market camp, meaning the charts align with the comments from the ISM chair at the top of the article. Consequently, we incrementally increased our equity exposure (SPY) earlier this week. Since breakouts can fail and slopes can flip from up to down, we are still maintaining some respect for the recent indecisive environment via exposure to bonds (TLT) and cash. TLT gained 0.87% in Tuesday’s session.

The Fed And Inflation

Wednesday brings a pre-opening bell report on producer prices. The market will be looking for insight into inflationary trends and their possible impact on Fed policy. From an emerging risk perspective, if inflation starts to pick up with ongoing tepid economic growth, the bearish vigilante scenario could quickly come into play.

This article is © 2014 Ciovacco Capital Management and originally appeared here and is reprinted by permission.

See Also:

- Happy 160th Birthday, Charles Dow

- Why Should I Learn Elliott Wave Theory

- The Three Phases of a Trader’s Education

- Are High Frequency Traders Rigging the Stock Market?

Copyright © 2014 Ciovacco Capital Management, LLC. All Rights Reserved. Chris Ciovacco is the Chief Investment Officer for Ciovacco Capital Management, LLC (CCM). Terms of Use. This article contains the current opinions of the author but not necessarily those of CCM. The opinions are subject to change without notice. This article is distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product.

Speak Your Mind