Why 1976 Is Relevant On The S&P 500 Index

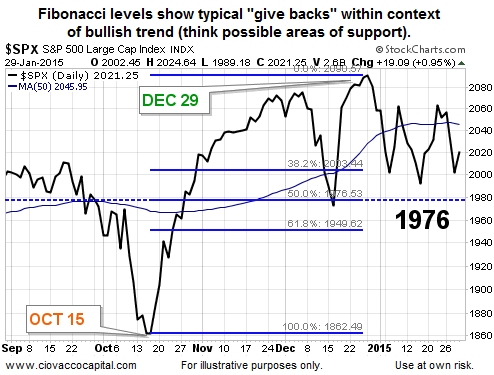

Math plays a big role in nature and the financial markets. Many trading algorithms use Fibonacci retracement levels to identify areas where buyers may become interested (support). The math below may be helpful to us in the coming days – at a minimum, it is prudent to be aware of the possibility of a bounce near 1976 should the market test that area:

The S&P 500 closed at 1862.49 on October 15; then rallied to a closing high of 2090.57 on December 29, which is a 228.08 point gain. A 50% retracement of that gain is 114.04 points, which means the 50% Fibonacci retracement level is 1976.53. The S&P closed Thursday at 2021.25. Therefore, the S&P would need to drop 44.72 points on Friday to reach 1976.53.

GDP – Not Too Hot, Not Too Cold

As we hypothesized on January 29, it is possible the “within the consensus range” GDP report will assist in calming the markets a bit. While Friday’s GDP reading of 2.6% growth reduces the odds of an imminent bear market in stocks, it does not take the correction scenario off the table. Therefore, as always it is important for us to remain flexible and open-minded, especially near 1976 on the S&P 500.

How Will We Use 1976?

It is simply a probabilistic reference point – nothing more, nothing less. As long as the S&P 500 can close above 1976, we can add a “try to be patient” factor into the equation. For us, a close above 1976 may not allow for a “do nothing” session since the readings on the market model (a.k.a. the hard evidence) align with a less favorable risk-reward profile for equities. Regardless, 1976 is a relevant guidepost over the next week or so.

You might also like:

- Using Trend Lines and Identifying Support and Resistance

- Fibonacci Clusters Show Important Resistance Level in Gold

- Fibonacci in Nature

- Applying Fibonacci to Stock Market Patterns: It’s easier than you might think!

Golden Rectangle image from Patrick Hoesly.

This article by Ciovacco Capital originally appeared here and

[…] Fibonacci Levels Create Key Support for S&P 500 […]