Bad Breadth Can Foreshadow Bear Markets

Market breadth speaks to the number of stocks participating in an advance. Strong market breadth means a high percentage of stocks are making new highs as the major indexes make new highs. Strong breadth also aligns with widespread confidence in stocks and the economy.

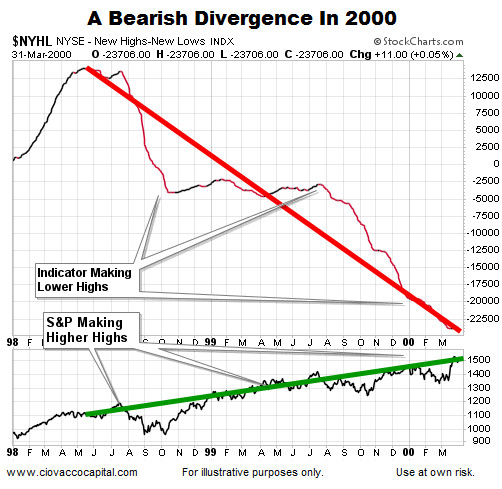

Bearish Divergence In 2000

The chart below tracks the number of NYSE stocks making new highs minus the number making new lows. A bearish divergence was clearly evident well before the bull market peaked in March 2000.

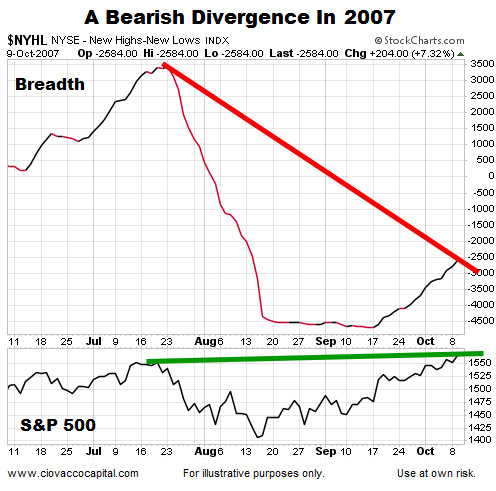

Bearish Divergence In 2007

NYSE New Highs – New Lows ($NYHL) also failed to confirm the S&P 500’s new high in October 2007, telling us many stocks were already showing signs of weakness before the major averages peaked.

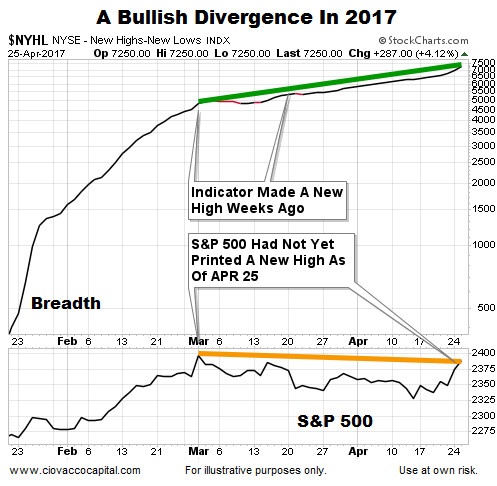

Bullish Divergence In 2017

How does breadth look as of April 25, 2017? Instead of a bearish divergence, $NYHL has a bullish divergence. The bullish divergence tells us the current rally has broad participation from both sector and market capitalization (small, mid, large cap) perspectives. Instead of waving yellow flags as it did in both 2000 and 2007, $NYHL is telling us to be open to new record highs in the major averages.

Is The Bigger Picture Also Leaning Bullish?

How does the S&P 500 look relative to the peaks in 2000 and 2007? Are risk-on/risk-off ratios waving yellow flags in 2017? Has the Trump trade followed a normal retracement path or something more concerning? These questions are addressed in this week’s stock market video.

How Does Breadth Help Us?

Like any chart or indicator, $NYHL helps us assess the probability of good things happening relative to the probability of bad things happening. The probability of bad things happening never drops to zero. Market breadth in 2017 leans toward the “good things happening” end of the spectrum looking out weeks, months, and years.

This article by Chris Ciovacco of Ciovacco Capital originally appeared here and has been reprinted by permission.

Speak Your Mind