During times of economic contraction, MOST ASSETS tend to move in tandem. The key to a balanced portfolio is to try to find assets with a negative correlation coefficient. A truly negative correlation would mean that when one asset goes up the other goes down. A correlation of -1.0 shows a perfect negative correlation, while a correlation of 1.0 shows a perfect positive correlation. It is extremely rare to find a perfect negative correlation and the correlation is not constant, but rather changes based on current market conditions and social mood.

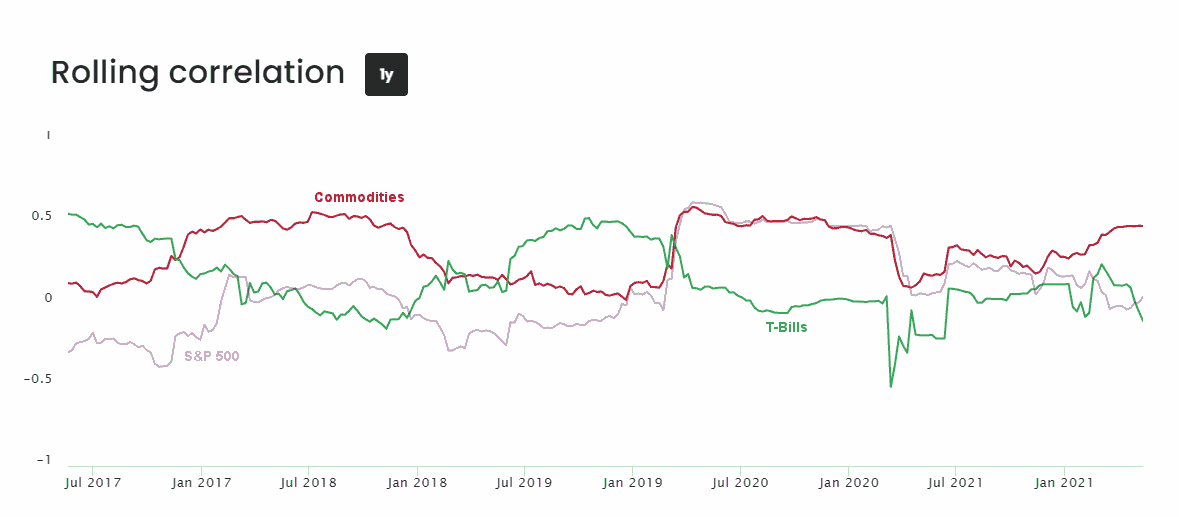

In the following chart, we see the 1-year rolling correlation of commodities, T-Bills, and the S&P 500. This is typically considered a strong negative correlation balance. At one point, during the COVID scare, t-bills reached -0.5 so nowhere near -1.0.

The demand for Bitcoin was initially driven by millennials with very little investing experience and then by more seasoned investors either riding the momentum of bitcoin, hoping for an inflation hedge other than gold, or simply for an alternative with a negative correlation to other investments. Another driving factor was simply liquidity. The FED was pumping massive amounts of liquidity into the market and it had to go somewhere so it went into stocks, housing, and even bitcoin.

At this point, the momentum for bitcoin is falling and it doesn’t appear to be as negatively correlated to other markets as some investors had hoped, so we are seeing falling bitcoin prices, along with everything else. During severe market contractions, the only thing that doesn’t lose value is cash, unfortunately, during times of high inflation, even cash loses value so investors turn to commodities and precious metals. During the 2008 meltdown gold initially lost value as speculators sold gold to cover margin calls. But it quickly recovered as investors realized that gold was the only asset that wasn’t simultaneously someone else’s liability. So the question arises, “Will Bitcoin turn out to be an Asset or a Liability”? ~Tim McMahon, editor

Is Bitcoin Headed to Zero?

Is Bitcoin Headed to Zero?

“40% of bitcoin investors are now underwater”

By Elliott Wave International

Charlie Munger is Berkshire Hathaway’s co-chairman, and on April 30 at the firm’s shareholder meeting, he said:

“Bitcoin is stupid because it’s very likely to go to zero.”

Berkshire Hathaway chairman Warren Buffet also expressed a negative sentiment toward the cryptocurrency.

Bitcoin’s recent price action appears to support the views of the two billionaire investors, at least at this juncture.

Here’s a CNBC headline from the evening of May 9:

“Bitcoin dips below $30,000, drops more than 56% from its all-time high”

Keep in mind that just days ago, the cryptocurrency was trading north of $40,000. The last time Bitcoin traded below $30,000 was last July. As you might imagine, many crypto investors were quite fearful then.

Indeed, a July 9, 2021 Bloomberg headline captured the sentiment of the global chief investment officer of a major financial firm:

“Bitcoin ‘Crash’ Risks Taking Its Price Down to $10,000”

Speak Your Mind