“The Stock Market is Driven by Social Mood… Not by Reason”

By Elliott Wave International

Stock market observers are trying to “make sense” of the wild price moves, which have mainly been to the downside.

As a May 12 CNBC headline says:

Traders search for answers as relentless selling on Wall Street looks to be detached from reality

Many market participants believe the “reality” of economic statistics, earnings and other factors external to the market govern the market’s trend.

However, that’s a fallacy.

Let’s get insights from a classic Elliott Wave Theorist, a monthly publication which provides analysis of financial markets and social trends:

We sometimes hear that a market “doesn’t make sense.” Of course, our whole model is that markets fail to make sense, not just sometimes but all the time.

The stock market is driven by social mood — waves of optimism and pessimism — not reason.

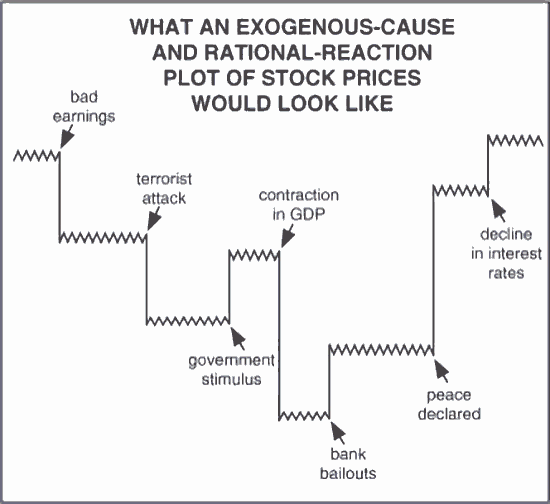

Think about it: If the stock market was governed by external events, a price chart would look something like this:

This is a diagram from Robert Prechter’s landmark book, The Socionomic Theory of Finance, which shows a mix of good and bad news and how the market would “reasonably” behave if events governed prices.

However, as you know, this is not how price charts look.

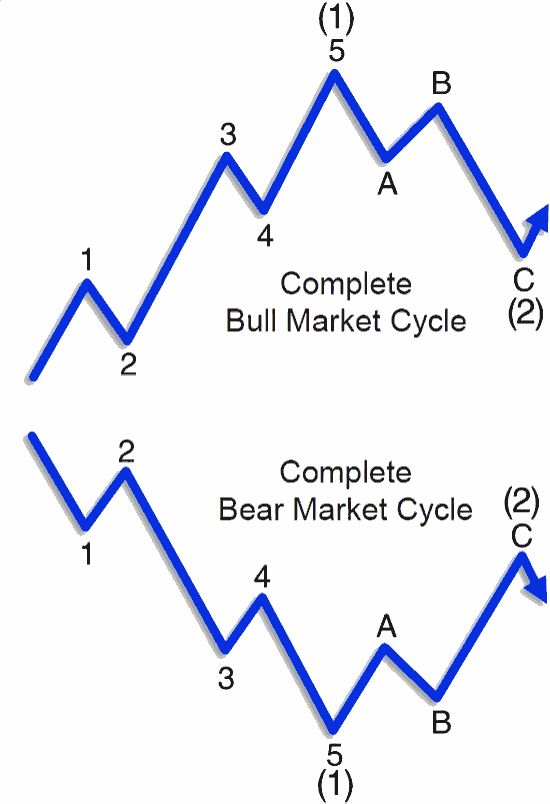

The “waves of optimism and pessimism” which do govern the trend of market prices are directly reflected by the Elliott wave model. Here’s an idealized depiction of those waves in both bull and bear market cycles:

Indeed, the Elliott wave model helped our U.S. Short Term Update editor make this call about the Dow Industrials on Jan. 3:

[T]he fifth wave should be complete or very nearly so.

Just two days later, on Jan. 5, the Dow hit its all-time high intraday.

Understand that not every forecast based on the Elliott wave model works out to a “T.” At the same time, the Wave Principle reflects how the stock market works and is preferable to basing your outlook on events outside of the market.

Let’s return to that classic Elliott Wave Theorist:

You are way ahead of others’ understanding when you begin with the realization that under the traditional model of exogenous cause markets sometimes seem to make sense and sometimes not, whereas by our model the markets always make perfect non-sense.

Get insights into how the Elliott wave model can help you analyze financial markets by reading Frost & Prechter’s Wall Street classic, Elliott Wave Principle: Key to Market Behavior. Here’s a quote from the book:

The Wave Principle is governed by man’s social nature, and since he has such a nature, its expression generates forms. As the forms are repetitive, they have predictive value.

Sometimes the market appears to reflect outside conditions and events, but at other times it is entirely detached from what most people assume are causal conditions. The reason is that the market has a law of its own. It is not propelled by the external causality to which one becomes accustomed in the everyday experiences of life. The path of prices is not a product of news. Nor is the market the cyclically rhythmic machine that some declare it to be. Its movement reflects a repetition of forms that is independent both of presumed causal events and of periodicity.

The market’s progression unfolds in waves.

You may be interested in knowing that you can access the online version of the book for free once you become a Club EWI member [membership is also Free].

Club EWI is the world’s largest Elliott wave educational community with approximately 500,000 worldwide members. As a member, you’ll gain free and instant access to a wealth of Elliott wave resources on financial markets, investing, and trading without any obligation.

Just follow the link to get started now: Elliott Wave Principle: Key to Market Behavior — free and unlimited access.

More articles about Socionomics:

- Are Disease Outbreaks Market Indicators?

- Rise of the “Know Nothings”

- Deflationary Psychology Versus the Fed: Here’s the Likely Winner

- Want to See What’s Next for the Economy? Try This.

- The Disruptive New Science that Shatters Today’s Investing Paradigm

- Non-Traditional View of the Markets

- The Investor’s Battle Between Hope and Fear

Speak Your Mind