Stock market observers are trying to “make sense” of the wild price moves, which have mainly been to the downside.

As a May 12 CNBC headline says:

Traders search for answers as relentless selling on Wall Street looks to be detached from reality

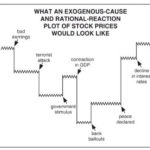

Many market participants believe the “reality” of economic statistics, earnings and other factors external to the market govern the market’s trend.

However, that’s a fallacy.

Let’s get insights from a classic Elliott Wave Theorist, a monthly publication which provides analysis of financial markets and social trends:

Why Investors are Consistently Fooled by the Stock Market

Capital Gains Tax Hike News: Was It REALLY to Blame for Sell-off?

As Elliott Wave International has noted many times, the mainstream financial press always tries to find a reason for a given trading day’s stock market action.

In other words, if stocks happen to be up for the day, many financial journalists will say it was because of this or that “positive” news. If stocks happen to be down for the day, you got it, these journalists will ignore the positive news and search for something “negative” that happened in the country or world and say that was the reason stocks went down.

What is Forex News Trading?

The Forex market remains a source of great opportunity for investors, thanks primarily to its high levels of leverage and liquidity. It is a margin based investment opportunity, which enables shrewd and experienced operators to gain returns that can dramatically exceed their initial financial commitment. But it also brings considerable risk, however, as less fortunate traders […]