Two of the greatest motivators in the financial arena are Fear and Greed. Unfortunately, many traders fall victim to their enticement and end up making disastrous mistakes. But by getting your emotions under control you can follow the sage advice of Warren Buffet and “Be fearful when others are greedy and greedy when others are fearful”.

Have Smartphone Sales Peaked?

In the following article charts from Statista.com looks at the Cell Phone sales situation as of the end of the 3rd quarter of 2018. At this point it looks like sales have leveled off but it is quite possible that people are simply waiting for the advent of the new 5G phone capability.

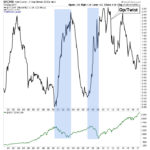

SPX CYCLES, FED FUNDS AND GOLD

In the following article by Gary Tanashian of Notes from the Rabbit Hole which he refers to as “NFTRH” Gary looks at the 12 month and 30 month S&P 500 cycle, FED Funds and his proprietary Gold “Macrocosm picture” which includes looking at Gold in various currencies. This is important because since gold is an international commodity, if an individual currency is falling it could appear that gold is rising and if a currency is rising (against other currencies) it could appear that gold is falling. So we need to look at gold in terms of a variety of currencies to eliminate the currency exchange issue and determine what gold itself is actually doing rather than gold versus an individual currency.

The Silver/Gold Ratio, Inflation/Deflation and The Yield Curve

The following article was written by Gary Tanashian editor of Notes From The Rabbit Hole (NFTRH) and originally appeared here. In it Gary looks at the current “Dysfunctional Market” the FED manipulation called “Operation Twist” that caused it along with Gold, Silver, plus inflation and deflation. I like his quote about the effects of inflation, “Funny money on the run… is not discriminating money. It seeks assets… period.” and he holds that that is the primary reason why the stock market has risen since 2011.

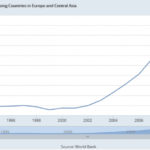

US Drives Global Growth

The US is back in the driver seat again as a sustained and growing economic powerhouse – the Trump Economy. Since the November 2016 elections, the US economic data and outlook have been driving investment in US equities as well as select foreign investment opportunities. The reduction in regulations and business friendly Trump administration seems to have unleashed the hoard of cash and opportunity of the past 7+ years. US and foreign business are, again, “wheeling and dealing” with the intent of generating greater profits and more opportunities.

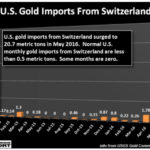

Something Strange in the Gold Market

Gold has a strong negative correlation to other assets. That means that when other markets fall gold can hold steady or even rise. This makes it the ultimate portfolio insurance.

Economic Cycles of Energy and Technology

Everything moves in cycles whether it is the price of a barrel of oil, the overall stock market, real estate or technology. So where is it heading from here? Are we in for a boom or a bust? That is always the key question. Is it time to be skeptical of the markets, bullish on gold, or does the stock market hold the key? In today’s article Jared Dillan editor of Bull’s Eye Investor, takes a look at where we’ve been and where we are going.

Warning: Fast Moving Market

As volatility decreases people get complacent and get in a rut things become “normal” and so they are less alert to the bear around the next corner waiting to maul them. In today’s article Jared Dillian, editor of Bull’s Eye Investor, looks at the effects this complacency can have on your investments.

The Big, Bold and Ugly

Since July of 2014 the big cap stocks have continued to make new highs as investors dump more and more money into the stock market. Overall bullishness on the stock market is now at extremely high levels which typically happen before a major stock market correction and sometimes start a full blown bear market.

Floating-Rate Funds Poised to Profit as Interest Rates Rise

Typically, as I’m sure you are aware interest rates and bond prices have an inverse relationship. That means when interest rates rise bond prices fall. But in today’s article we will look at a different type of bond fund that avoids that type of risk.