Two of the greatest motivators in the financial arena are Fear and Greed. Unfortunately, many traders fall victim to their enticement and end up making disastrous mistakes. But by getting your emotions under control you can follow the sage advice of Warren Buffet and “Be fearful when others are greedy and greedy when others are fearful”.

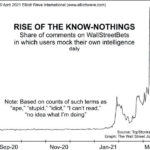

Rise of the “Know Nothings”

With the longest “Bull market” in history in full swing young investors are flocking to the market with no experience of ever having seen a full-fledged crash only “corrections” that are quickly reversed into higher and higher valuations. Twenty-somethings were still in elementary school in 2008 so it is a distant memory… let alone 2002-3 or 1989. With no experience in dealing with a crash, they are plunging into the market at record levels.

The Psychology of Volatility

Nobody likes minus signs and red screens, which create a feeling of being out of control. While hitting a sell button can make us feel like we are back in control, it often leads to overtrading and disappointing returns.

The Three Phases of a Trader’s Education

Learn Jeffrey Kennedy’s tips for becoming a consistently successful trader You’ve probably heard talk about “market uncertainty” in the financial news recently. But when are the market trends ever certain? The constant uncertainties contribute to your frustrations as a trader, and you need to have a method for dealing with the ups and downs. Every successful trader […]