Experienced traders and investors respect and understand the concept of “Don’t fight the Fed”. The basic rationale behind the expression is that when the Fed is printing money, the odds are tilted in the bulls’ favor. Conversely, when the Fed is tightening policy, bearish odds begin to pick up.

What Fight Are We Trying To Avoid?

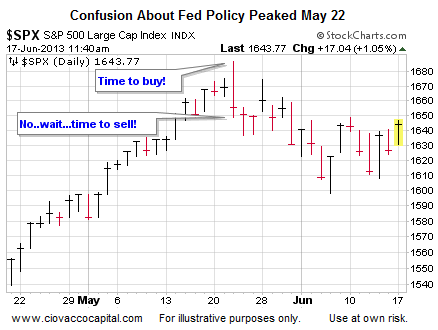

One of the most frustrating aspects of investing during Ben Bernanke’s watch is the constant stream of conflicting messages being delivered by members of the Federal Reserve. One day the market may hear from a pro money printing Fed governor. The next day investors may hear talk of the need to “taper” the pace of the Fed’s bond buying program. The confusion in markets was evident on May 22 when the S&P 500 spiked higher early in the session as Ben Bernanke’s remarks hinted at a steady stream of money printing. Later in the session after the Fed minutes were released, the rush to buy was replaced with a rush to sell as traders began to believe Fed tapering was coming sooner rather than later.

A Prudent Fed Strategy

With the Fed due to deliver a formal policy statement this Wednesday, it makes sense to identify a line in the sand to discern between “leave my investments alone” and “I need to play some defense”. As outlined at the 2:21 mark of the video below, we believe the line in the investor’s sand can be drawn at 1593 on the S&P 500.

The Trend Is Your Friend

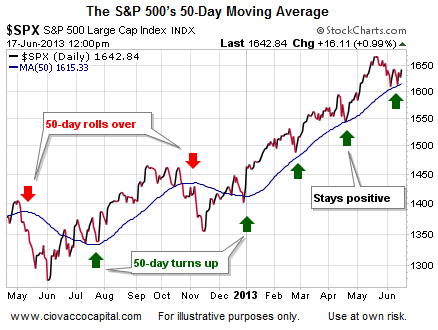

One of the reasons for exercising some patience above 1593 on the S&P 500 is based on the market’s current bullish trend. Traders use the slope of the 50-day moving average to monitor the market’s intermediate-term trend. As shown below, not too many bad things happen as long as the slope of the 50-day is positive or flat. The 50-day is shown in blue. As of noon Monday, the slope of the 50-day was still positive, which is indicative of a bullish trend.

Fed Is Fuzzy – Chart Is Clear

It is unlikely this week’s Fed statement completely removes the market’s confusion regarding the future pace of printing press utilization. From Bloomberg:

What central banks may have the world over is a failure to communicate. Officials are struggling to spell out their visions for monetary policy, often amid a chorus of competing views. Chairman Ben S. Bernanke is trying to manage expectations about when the Federal Reserve will slow asset purchases and raise interest rates. Bank of Japan Governor Haruhiko Kuroda’s reflation-push is backfiring by driving up bond yields. European Central Bank President Mario Draghi is dashing investors’ hopes he once kindled for extra stimulus. The muddied messaging already is roiling financial markets, threatening to undermine the confidence of investors, households and consumers and so undoing efforts by central banks to strengthen their economies.

Even if we had an advance copy of this week’s Fed statement, it would be difficult to anticipate the market’s reaction to it. The reaction may be one of fits and starts. The charts provide us with clear and unambiguous feedback, which is in stark contrast to trying to interpret a Fed policy statement.

Investment Implications

The number of inputs when making investment decisions are nearly limitless. Our strategy this week will be to err on the side of holding our long positions in stocks as long as (a) the slope of the S&P 500’s 50-day remains positive, and (b) the S&P 500 remains above 1593 on a closing basis. Until some conviction returns from buyers, we prefer diversified stock plays, such as the S&P 500 ETF (SPY) and technology (QQQ). If (a) and (b) above are no longer in place, we will consider more defensive positions, such as consumer staples (XLP) and bonds (AGG).

Reprinted with permission. Originally posted here.

[…] Navigating A Fed-Dependent Market […]