Why You Should Pay Attention to This Time-Tested Indicator Now

"How High Can Markets Go?" -- asks this magazine cover By Elliott Wave International Paul Montgomery's Magazine Cover Indicator postulates that by the time a financial asset makes it to the cover of a well-known news weekly, the existing trend has been going on for so long that it's getting close to a reversal. A classic case in point is this Time magazine cover from June 13, 2005: As you can see, it says, "Home $weet Home," followed by "Why we're going gaga over real estate." Interestingly, this was published around the time that the S&P Supercomposite Homebuilding index was peaking. The housing bubble of that time was on the verge of bursting, and you'll likely remember that major crash. … [Read More...]

Bob Prechter on the Rich Dad Radio Show

Our friends at Elliott Wave International just published an interesting interview between Rich Dad Radio Show guest host Tom Wheelright and EWI Founder and President Bob Prechter.

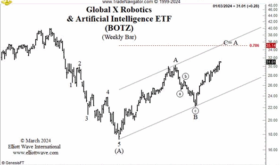

A.I. Revolution and NVDA: Why Tough Going May Be Ahead

The topic with all the buzz these days is Artificial Intelligence (AI) and its future. The potential benefits include automating repetitive tasks, enhancing productivity, data analysis, assisting in medical research — and more.

… the mood surrounding AI is way more optimistic than pessimistic.

Just think about how investors have bid up the price of AI-related stock Nvidia Corp., which has a market capitalization of around $2 trillion. That’s more than the GDP of Australia or South Korea. Indeed, if Nvidia was a country, it would rank just outside the top ten largest economies on Earth. Yet — a word of caution: Trends generally don’t go up or down in straight lines without significant interruptions.

Free report: ‘Gold Investors’ Survival Guide’

Gold prices are breaking records so our friends at Elliott Wave International have created a free guide to help you get on the right track.

Why You Should Expect a Once-in-a-Lifetime Debt Crisis

The following article by Elliott Wave International looks at the possible impact of the building debt crisis. We've all heard about the massive problem of College debt created by the easy-money policies of the government. But today we are looking at … [Read More...]

Why Do Traders Really Lose Money?

We've all probably heard that "the odds are stacked against the small trader" when it comes to the stock market. That tends to push us toward investment tools like index funds. But what if the problem isn't the market but our own brain? In today's … [Read More...]

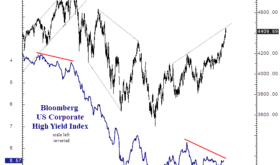

Stocks and Junk Bonds: “This Divergence Appears Meaningful”

By Elliott Wave International The trends of the junk bond and stock markets tend to be correlated. The reason why is that junk bonds and stocks are closely affiliated in the pecking order of creditors in case of default. The rank of junk bonds is … [Read More...]

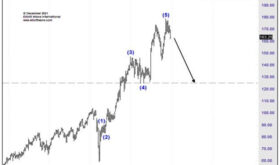

Market Outlook May 31, 2023

On 12/28/2022 the NASDAQ bottomed at 10,213.29 since then it has soared about 27% to 12,971 as of this writing. This happened despite the media beating the gloom and doom drum of the "Debt Ceiling". John Authers of Bloomberg published an article … [Read More...]