The Popgun Bar Pattern-

The popgun is a simple bar pattern trade setup that uses 2 bars that can help you quickly spot a potential trade. It is simply an inside bar followed by an outside bar. Don’t worry if you don’t know an inside bar from your elbow, we’ll explain that in a minute. Although this pattern is nothing new for seasoned traders it is an important formation for every trader to know because it often signals a coming sizable move.

By Elliott Wave International

By Elliott Wave International

Editor’s note: Elliott Wave International is hosting Trader Education Week, September 26 through October 3. During this event, analyst Jeffrey Kennedy will share video trading lessons that will empower you to improve the way you trade. Register now for your FREE week of trading lessons and resources.

The Popgun

I’m no doubt dating myself, but when I was a kid, I had a popgun — the old-fashioned kind with a cork and string (no fake Star Wars light saber for me). You pulled the trigger, and the cork popped out of the barrel attached to a string. If you were like me, you immediately attached a longer string to improve the popgun’s reach. Why the reminiscing? Because “Popgun” is the name of a bar pattern I would like to share with you this month. And it’s the path of the cork (out and back) that made me think of the name for this pattern.

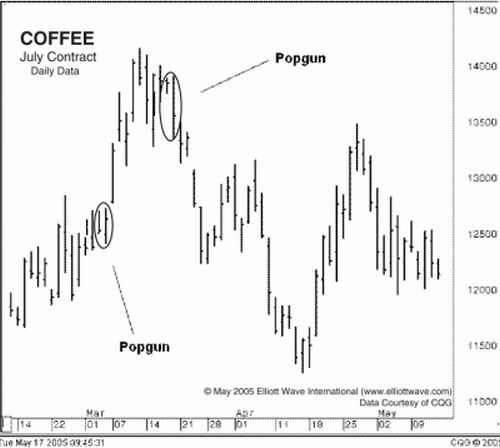

In Chart 1 -Coffee (above), I have circled two Popguns.

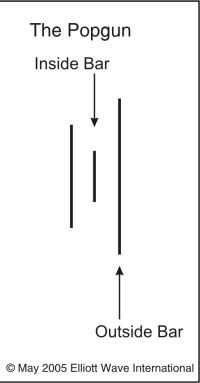

The Popgun is a two-bar pattern composed of an outside bar preceded by an inside bar.

Quick refresher course:

- Outside and inside bars are always compared to the previous bar not to each other.

- An outside bar occurs when the range of a bar encompasses the previous bar. In other words, it is both higher and lower than the previous bar.

- An inside bar is a price bar whose range is encompassed by the previous bar i.e. the previous bar was higher and lower than current bar.

So what’s so special about the Popgun? It introduces swift, tradable moves in price. More importantly, once the moves end, they are significantly retraced, just like the popgun cork going out and back. Prices can advance sharply following the Popgun, and then the move is significantly retraced. Or the same thing can happen to the downside: prices fall dramatically after the Popgun, and then a sizable correction develops.

How to Use the Popgun

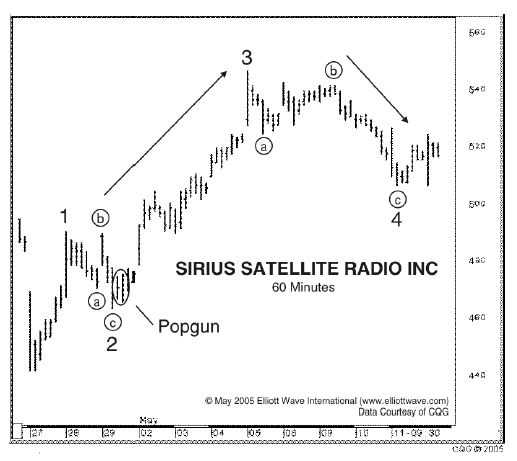

How can we incorporate this bar pattern into our Elliott wave analysis? The best way is to understand where Popguns show up in the wave patterns. I have noticed that Popguns tend to occur prior to impulse waves — waves one, three and five. But, remember, waves A and C of corrective wave patterns are also technically impulse waves. So Popguns can occur prior to those moves as well.

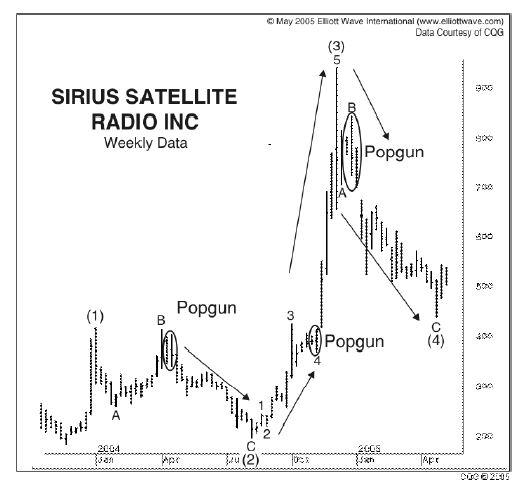

As with all my work, I rely on a pattern only if it applies across all time frames and markets. To illustrate, I have included two charts of Sirius Satellite Radio (SIRI) that show this pattern works equally well on 60-minute and weekly charts. Notice that the Popgun on the 60-minute chart preceded a small third wave advance.

Now look at the weekly chart to see what three Popguns introduced (from left to right), wave C of a flat correction, wave 5 of (3) and wave C of (4).

This article is an excerpt from the FREE 15 page Report- How to Use Bar Patterns to Spot Trade Set Ups- Download your copy of the full Report Here.

[…] The Popgun: A Two-Bar Pattern that Points to Trade Setups […]