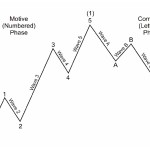

In the Elliott Wave model, market prices alternate between the primary trend (or impulsive) and the corrective phase. Impulse waves are always subdivided into a set of 5 lower-degree waves. Corrective waves subdivide into 3 smaller-degree waves. In a bull market the dominant direction is upward so the five waves would be upward. In a bear market the dominant direction is downward, so the pattern is reversed—five waves down and three up. Motive waves always move with the trend, while corrective waves move against it. The following is a description of the market psychology during the Major primary waves. Of course inside of each of these waves are smaller waves that exhibit some of the same characteristics but on a smaller scale.

Wave three is usually the largest and most powerful wave in a trend. At this point in the cycle, the news is positive and fundamental analysts start to raise earnings estimates. Prices rise quickly and corrections are short-lived and shallow.

Wave three is usually the largest and most powerful wave in a trend. At this point in the cycle, the news is positive and fundamental analysts start to raise earnings estimates. Prices rise quickly and corrections are short-lived and shallow.

Wave five is the final leg in the direction of the dominant trend by this point the news is almost universally positive and everyone is bullish believing the market will continue upward forever. This is when many average investors finally buy in, right before the top. Volume is usually lower in wave five than in wave three, and many momentum indicators start to show divergences (prices reach a new high but the indicators do not reach a new peak).

Final Stages of The Advance on SP 500-The Wave Pattern

Over at The Market Trend Forecast.com service they have been projecting a potential rally pivot at 1552-1576 for many weeks now. The recent drop to 1485 although harrowing, was a normal Fibonacci retracement of the last major rally leg to 1531 pivot highs. We believe that this 5 wave advance 1343 pivot lows is nearing an end based on mathematics and relationships to prior waves 1-3.At 1569 the SP 500 would mark a perfect Fibonacci relationships to waves 1-3 for this final 5th wave to the upside. In the big picture, we are still working higher off the 1010 pivot lows on the SP 500, and this rally takes 5 full waves to complete. We think we are near wave 3 highs, and wave 4 correction would be up next, followed by another thrust to highs if all goes well this year.That all said, a multi-week correction and consolidation wave 4 pattern is likely once we pivot at 1552-1576. We should expect this correction to retrace anywhere from 80-100 points on the SP 500, but one week at a time.

Speak Your Mind