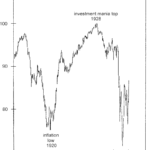

Financial advisors have long advocated a mix of 60% stocks / 40% bonds to cushion portfolios from downturns in the stock market. The thinking is that stocks go up in the long-term, hence, that’s where investors should allocate the most. At the same time, advisors acknowledge that stock prices can sometimes go down so “less risky” bonds will provide at least some protection. The problem with this investment strategy is that bonds can go into bear markets too. Moreover, they can do so at the same time as stocks. Let’s review what happened during the Great Depression of the early 1930s.

Tools for Technical Analysis

Search This Site

Subscribe NOW!

Never wonder again about whether the new information is out yet. You will be the first to know about the Elliotwave articles, Current Inflation and Unemployment Data and Financial Trend Forecaster Articles.

Plus you will also get the following special report absolutely free: “15 Ways to Beat 95% of All Investors”.

Click Here to SubscribeSearch

Articles by Category

Articles by Date

Disclaimer

Privacy & Terms of Use

Work by editor and author, Tim McMahon, has been featured in Bloomberg, CBS News, Wall Street Journal, Christian Science Monitor, Forbes, Washington Post, Drudge Report, The Atlantic, Business Insider, American Thinker, Lew Rockwell, Huffington Post, Rolling Stone, Oakland Press, Free Republic, Education World, Realty Trac, Reason, Coin News, and Council for Economic Education. Connect with Tim on Google+ Read More…

Copyright © 2026 · Capital Professional Services, LLC · Maintained by Intergalactic Web Designers · Admin