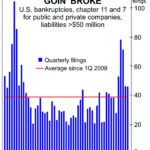

Typically, as you would expect, corporate bankruptcies occur most frequently when the economy is bad. Marginal companies that were just hanging on in “good times” are the first to fail as money gets tighter. The last spike in corporate bankruptcies was in the aftermath of the 2008 crisis. But in 2020, we saw another spike in bankruptcies from a different cause, i.e. COVID shutdowns. Despite government subsidies, bankruptcies soared, the economy tanked, and millions of people sat home and collected enhanced benefits. So now that we are halfway through 2021, how are we faring?

Bond Market: “When Investors Should Worry”

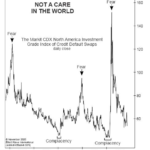

You may recall hearing a lot about “credit default swaps” during the 2007-2009 financial crisis. As a reminder, a CDS is similar to an insurance contract, providing a bond investor with protection against a default.

In the past several months, the cost of that protection has fallen dramatically. The November Elliott Wave Financial Forecast, a monthly publication which provides an analysis of major U.S. financial markets, showed this chart and said: