You may recall hearing a lot about “credit default swaps” during the 2007-2009 financial crisis. As a reminder, a CDS is similar to an insurance contract, providing a bond investor with protection against a default.

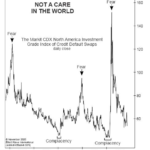

In the past several months, the cost of that protection has fallen dramatically. The November Elliott Wave Financial Forecast, a monthly publication which provides an analysis of major U.S. financial markets, showed this chart and said:

Bond Market: “When Investors Should Worry”

More Credit Default Swaps Means Trouble for European Debt

Government debt is no longer just a problem for emerging countries. Portugal, Spain, France and Greece (as we have seen in recent weeks) are living in fear of credit default. Consequently, the value of their credit default swaps is skyrocketing.