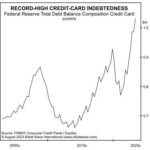

The following article by Elliott Wave International looks at the possible impact of the building debt crisis. We’ve all heard about the massive problem of College debt created by the easy-money policies of the government. But today we are looking at the impact of the massive credit card debt.

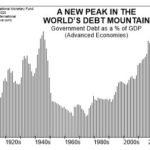

A Global “Debt Mountain”: Beware of This “New Peak”

Most people going about their daily business probably never give a moment’s thought to global debt. But, in EWI’s view, the topic deserves serious attention. You only have to think back to the 2007-2009 subprime mortgage meltdown to know why. Of course, subprime mortgages are a form of debt, and when many of these loans turned sour, the entire global financial system teetered on the brink of collapse. But, why were so many of these bad loans made in the first place? It boils down to one word: confidence … confidence that the loans would be repaid, confidence that the stock market would continue to rally, confidence in the economy, and confidence in the future, in general.

More Credit Default Swaps Means Trouble for European Debt

Government debt is no longer just a problem for emerging countries. Portugal, Spain, France and Greece (as we have seen in recent weeks) are living in fear of credit default. Consequently, the value of their credit default swaps is skyrocketing.