“Confident trader.” Ten-fifteen years ago, the idea used to be an oxymoron — and now, it’s a multi-billion self-help industry with everyone from Wall Street gurus to armchair experts offering their brand of motivational wisdom:

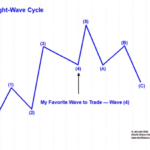

This High-Confident Trade Set-up Makes for Highly-Confident Traders

Flexibility Important During Indecisive Periods

The Fundamentals are Reflected in the Charts The market’s pricing mechanism, is based on the aggregate opinion of every investor around the globe and thus allows us to compare economic confidence in late 2007 to the present day. A more direct way to say it is “charts enable us to monitor the conviction that stocks […]