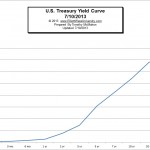

What is the Yield Curve? The yield curve is a graphical representation of several “yields” or interest rates over varying contract lengths i.e. 1 month, 2 months, 3 months, 1 year, 2 years, 10 years, etc… The curve shows the relationship between the interest rate or cost of borrowing and the time to maturity. For example, interest rates paid on […]

Deflation: How To Survive It

The M3 money supply in the U.S. is contracting fast, and deflation is suddenly in the news again. It’s a good moment to catch up on a few definitions, as well as strategies on how to beat this rare economic condition. And who better to ask than EWI’s president Robert Prechter? Here’s a free excerpt from a collection of his most important essays on deflation.

The Federal Reserve Does NOT Control the Market

As the world’s leading stock markets continue to play stomach-hockey with investors via one triple-digit turn after another, the mainstream community takes solace in this core belief: No matter how uncertain things become, the Federal Reserve can at any moment swoop in to set the economy right.

You Still Believe The Fed Can Stop Deflation?

Think back to the fall of 2007. The deflationary “liquidity crunch” that over the next year-and-a-half cuts the DJIA in half, decimates commodities, real estate and world markets is only starting. Almost no one believes that the crash is coming — to a large degree, because everyone is convinced that the U.S. Federal Reserve Bank, with Ben Bernanke at the helm, will never allow deflation to happen: It can just print money! Well, take a look at these two charts EWI’s president Robert Prechter’s published in October 2007.