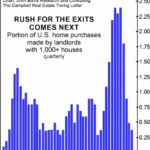

Real estate prices have reached absurdly high prices because corporate investors have taken over the housing market from individuals in a program encouraged, once again, by the federal government. “…24% of U.S. single family homes are owned by investors.” When the bulk of participants in the market are consumers who think of houses as shelter, prices are stable. When a significant portion of participants in the market are speculators who think of houses as investment items, prices soar and crash.

A Change May Be Nigh for Real Estate

House buyers want to buy at a favorable price, house sellers want to get the most for their property. But for the past several months — across the country — buyers have often had a tricky time finding a reasonably priced home. A recent headline says, “home prices have risen 100 times faster than usual.” And on InflationData we just updated the Inflation-Adjusted Real Estate Index adding data all the way back to 1890. We look at the idea that housing prices “always go up”.

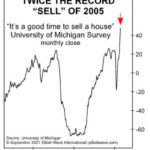

The Maniacal Residential Real Estate Market

If you’ve heard anything about Real Estate in the last year you’ve heard about how crazy the market is getting. People are buying houses sight-unseen for more than the asking price. It’s just crazy. Anyone who has ever experienced any sort of bubble mentality knows that this is exactly what a bubble feels like. The problem with bubbles of course is that they always last longer and go higher than a rational person would think possible. And I guess that is sort of the point… a bubble occurs when prices are no longer rational. The tricky part is knowing when the bubble is going to pop. This reminds me of the old saying that says “it is better to get out a month too early than a day too late.” The following video talks about the condition of the current Real Estate market and indicators of a top.

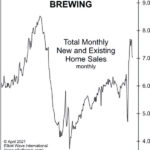

Why “Trouble is Brewing” for the U.S. Housing Market

We keep hearing about the “Housing Madness” that shows “No Signs of Slowing.” A would-be renter offered $2 million for a summer rental in the Hamptons and was turned down! Still, there are subtle but important signs of trouble in paradise. As the chart shows, total new and existing home sales made a countertrend rally high in October, which was still 21% below the all-time high in July 2005. As we have noted, home price declines follow home sales declines.