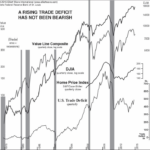

If the Balance of Trade is Negative i.e. Imports are greater than Exports a country will have a net outflow of currency and theoretically it will go broke. However, over the years the U.S. has been able to maintain a negative balance of trade by borrowing money from other countries i.e. selling them Treasury Bills, Bonds and Notes. So they give us money to buy stuff from them. On March 27, CNBC said that “the U.S. trade deficit fell much more expected in January to $51.15 billion, from a forecast $57 billion. The decline of 14.6 percent represented the sharpest drop since March 2018…” You would think this would be good for our economy as we are producing more and borrowing less. But it could also mean that we are buying less because our buyers have less money to spend. Conventional wisdom says that a falling trade deficit is good for stocks.There are many widely held beliefs about the stock market that are unverified, questionable or simply untrue. Even professional market observers often neglect to investigate these widely held beliefs for themselves — and their clients. Consider the claim that a falling trade deficit is good for stocks, and vice versa. In this article from Elliott Wave International they look at the relationship between a falling trade deficit and the stock market.

Tools for Technical Analysis

Search This Site

Subscribe NOW!

Never wonder again about whether the new information is out yet. You will be the first to know about the Elliotwave articles, Current Inflation and Unemployment Data and Financial Trend Forecaster Articles.

Plus you will also get the following special report absolutely free: “15 Ways to Beat 95% of All Investors”.

Click Here to SubscribeSearch

Articles by Category

Articles by Date

Disclaimer

Privacy & Terms of Use

Work by editor and author, Tim McMahon, has been featured in Bloomberg, CBS News, Wall Street Journal, Christian Science Monitor, Forbes, Washington Post, Drudge Report, The Atlantic, Business Insider, American Thinker, Lew Rockwell, Huffington Post, Rolling Stone, Oakland Press, Free Republic, Education World, Realty Trac, Reason, Coin News, and Council for Economic Education. Connect with Tim on Google+ Read More…

Copyright © 2026 · Capital Professional Services, LLC · Maintained by Intergalactic Web Designers · Admin