China’s housing bust has been in the news for a while now, so you might be wondering if their “command economy” has solved this problem yet. The mainstream media seems to be willing to give China a “Pass” and ignore the problem but by looking at China we can gain some insights. In today’s post by Elliott Wave International we will see where China stands today. ~Tim McMahon, editor

“Property market weakness is now spreading into China’s overall economy.”

By Elliott Wave International

If you’re wondering about the future value of your home or the housing market in general, you may want to pay attention to what’s going on in China.

The bottom line: The way we see it at Elliott Wave International, contagion may not be out of the question.

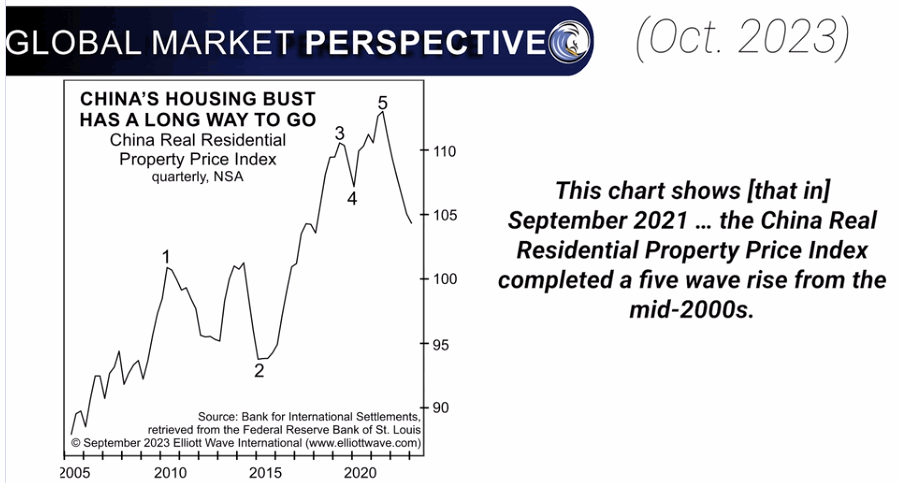

More than two years ago, we called attention to major red flags for the Chinese real estate market.

For example, our August 2021 Global Market Perspective noted that Chinese home prices were still climbing in many sectors, but major losses were suddenly occurring in many formerly sizzling neighborhoods.

By Aug. 25, the China Morning Post said:

China’s home prices are falling in districts where the most prestigious schools are located.

The Morning Post mentioned a case in point: A home sold for 42% less than a similar home in the same neighborhood just three months earlier.

So, it wasn’t surprising that in September 2021, housing prices in China had hit a peak.

Fast forward to our October 2023 Global Market Perspective, which provides an update:

Last month, [GMP] discussed some of the many ways in which property market weakness is now spreading into the overall economy.

Yet, economists have been somewhat dismissive of this threat.

Indeed, here’s a Sept. 25 Business Insider headline:

China’s Economic Situation Isn’t as Dire as It Seems

More than that, as our October Global Market Perspective also notes:

U.S. economists naturally continue to insist that American exposure to China’s weakening property prices is a non-issue.

It may not be wise to hang your hat on this sentiment expressed by U.S. economists.

There are already signs that “contagion” may be in the works.

For example, our recent Global Market Perspective provides Elliott wave analysis of the housing market for a northeastern U.S. state which is highly revealing — call it a major warning sign.

You can see that analysis — plus insights into U.S. markets and the economy — inside EWI’s new report “Essential Investor Insights from the November Global Market Perspective.” The report is available for free once you become a member of Club EWI, the world’s largest Elliott wave educational community. A Club EWI membership is also free and allows you free access to a wealth of Elliott wave resources on financial markets, investing and trading.

Get started by following this link: Essential Investor Insights from the November Global Market Perspective — free and instant access.

This article was syndicated by Elliott Wave International and was originally published under the headline Here’s an Update on China’s Big Housing Bust. EWI is the world’s largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

Speak Your Mind