There are a variety of indicators for when a market is getting “overbought” i.e. overpriced or ready to take a plunge or enter a major “retracement” phase. One indicator is “mergers and acquisitions” or “M&As”.

What are “mergers and acquisitions”?

The terms mergers and acquisitions are often used interchangeably, however, they have slightly different meanings. When a company takes over another company and establishes itself as the new owner, the purchase is called an acquisition. This generally occurs when a large company buys a smaller one. Such as when Amazon or Facebook buys a company that has a feature they want to incorporate into their system. The purchase could be on friendly terms or not. If the smaller company did not wish to be bought it is called a “hostile takeover”.

A “merger” usually occurs when two relatively equal-sized companies join together to become one larger company. Investopedia uses the example of the merger of Daimler-Benz and Chrysler to become Daimler Chrysler. “Both Daimler-Benz and Chrysler ceased to exist when the two firms merged, and a new company, DaimlerChrysler, was created. Both companies’ stocks were surrendered, and new company stock was issued in its place.”

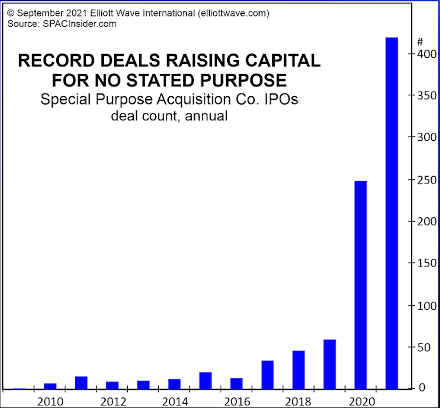

Historically we’ve seen that when market participants become overly optimistic, we are nearing a stock market top. This is logical because, at optimism peaks, everyone who has any money to invest has already invested it, so no one is left to buy. Conversely, when pessimism reaches extremes, no one is left to sell, so the market has to go up, as brave bargain-hunters re-enter the market. Recently we gave our subscribers the opportunity to view a presentation that Robert Prechter gave to an exclusive seminar in November 2021, showing how 25 major indicators were lining up to demonstrate that optimism was at an all-time high. I found one chart most interesting. It clearly demonstrates the current levels of extreme optimism. It shows the record number of people willing to throw money at an IPO with “no stated purpose”. In other words, people just gave the money away, HOPING the recipient would find something good to do with it! What???

You can still see this presentation for FREE with this coupon code: STOCKTOP. watch “A Stock Market Top for the Ages” with code STOCKTOP here. ~Tim McMahon, editor

M&As: Beware of This Major Sign of a Stock Market Top

Here’s what often precedes “prolonged and devastating bear markets.”

By Elliott Wave International

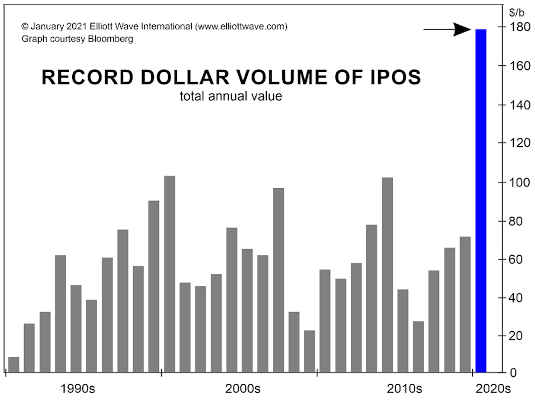

Inside the three publications that comprise Elliott Wave International’s flagship Financial Forecast Service, Elliott Wave International recently documented the many expressions of “financial optimism.” Things like crypto-mania. Or meme stocks. Or just buying any stocks, all stocks, no matter if the companies that issued them are making money, losing it, or have yet to turn a profit.

And it’s more than just the individual investors who are caught up in it. Among the other behaviors, this widespread financial optimism leads to are corporate mergers and acquisitions.

A corporate merger here or there may have little significance. However, when the biggest one in history occurs as part of a trend of a rising number of M&As — beware.

Consider a historical case-in-point: This is from the February 2000 Elliott Wave Financial Forecast, a monthly publication that provides analysis of major U.S. financial markets:

The euphoria surrounding AOL’s purchase of Time Warner may mark the top. As The Wall Street Journal put it, “The deal was heavy with superlatives and symbolism. It would be the biggest merger in history yahoo!”

That purchase had occurred about a month earlier [Jan. 10, 2000], which was within days of the Dow’s high.

As Robert Prechter’s At the Crest of the Tidal Wave noted:

Companies express optimism by taking over other companies. Such activity is indicative not of minor bull market tops, but of ones that precede prolonged and devastating bear markets.

That optimism was again evidenced for much of 2007. In January of that year, the Elliott Wave Financial Forecast again issued a cautionary note:

The other incredible expanding story is the “staggering” size and volume of corporate acquisitions. Newsweek and countless other articles find the rash of “bigger and bigger” deals “Phenomenally Positive” for the stock market.

Instead, later in 2007, the stock market hit another historic top.

This brief review of 2000 and 2007 is relevant in the early days of 2022. Here’s a Jan. 18 headline (CNBC):

Microsoft sets record for biggest tech deal ever, topping Dell-EMC merger in 2016

The headline is referencing Microsoft’s purchase of Activision Blizzard.

Ironically, this is unfolding as technology stocks are being punished.

Could this purchase by Microsoft be a sign of another stock market top?

Of course, only time will tell.

One thing’s for sure: the Elliott wave model is sending a major message that every investor should know.

If you’d like to learn about the Wave Principle, the definitive text on the subject is Frost & Prechter’s Elliott Wave Principle: Key to Market Behavior.

Here’s a quote from this Wall Street classic:

The Wave Principle often indicates in advance the relative magnitude of the next period of market progress or regress. Living in harmony with those trends can make the difference between success and failure in financial affairs.

Good news: You can read the entire online version of the book for free.

All that’s required for free access is a Club EWI membership. Club EWI is the world’s largest Elliott wave educational community, and membership is free. Moreover, Club EWI members enjoy free access to a wealth of Elliott wave resources on financial markets, trading and investing.

Just follow this link for free and unlimited access to Elliott Wave Principle: Key to Market Behavior.

You might also like:

- Has Crypto-Mania Finally Run Its Course?

- Is the Correction Over?

- Euro: Look at This Head & Shoulders Chart Formation

- Technology And The Semiconductor Chip Shortage

- How Blockchain’s Unique Innovations Can Prevent Money Remittance Scams

- NYSE Rate of Change Chart

This article was syndicated by Elliott Wave International and was originally published under the headline M&As: Beware of This Major Sign of a Stock Market Top. EWI is the world’s largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

Speak Your Mind